ETC Announces Fiscal 2015 Full Year and Fourth Quarter Results and Notice of Annual Meeting of Shareholders

SOUTHAMPTON, PA, USA, May 28, 2015 – Environmental Tectonics Corporation (OTC Pink: ETCC) (“ETC” or the “Company”) today reported its financial results for the fifty-two week period ended February 27, 2015 (“fiscal 2015”) and the thirteen week period ended February 27, 2015 (the “2015 fourth quarter”) and also announced that the Company’s Annual Meeting of Shareholders (the “Annual Meeting”) will be held at the Crowne Plaza Philadelphia – Bucks County in Trevose (Feasterville) located at 4700 E. Street Rd, Trevose, PA, 19053, USA on Wednesday, July 15, 2015, at 10:00 a.m.

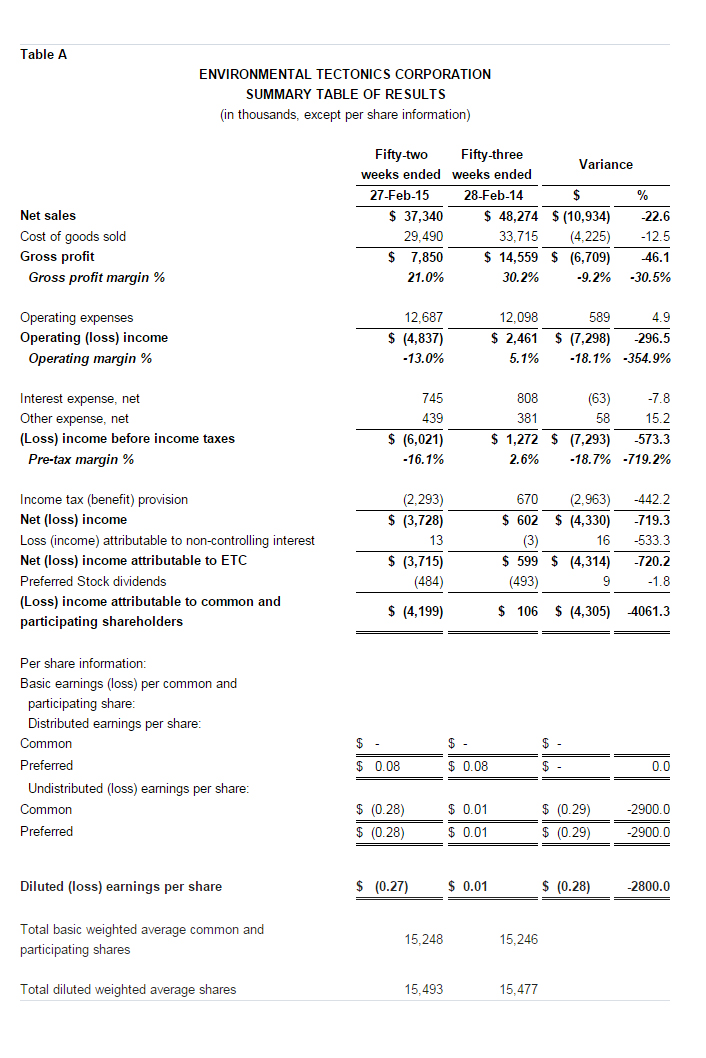

Fiscal 2015 Results of Operations

Net (Loss) Income Attributable to ETC

Net loss attributable to ETC was $3.7 million, or $0.27 diluted loss per share, in fiscal 2015, compared to $0.6 million of net income attributable to ETC during fiscal 2014, or $0.01 diluted earnings per share. The $4.3 million variance reflects a decrease in income before income taxes of $7.3 million due to a $6.7 million decrease in gross profit resulting from a combination of lower net sales and lower gross profit margin percentage, as well as a $0.6 million increase in operating expenses. The $7.3 million decrease in income before income taxes was offset, in part, by a $3.0 million variance between the income tax benefit recorded in fiscal 2015 and the income tax expense recorded in fiscal 2014.

Net Sales

Net sales for fiscal 2015 were $37.3 million, a decrease of $10.9 million, or 22.6%, from fiscal 2014. The reduction reflects decreased sales related to Chambers within our Aerospace segment to the U.S. Government, decreased sales in general to International customers, and decreased sales of monoplace chambers, offset in part, by increased ATS sales to the U.S. Government due primarily to an order for five (5) GYRO IPT II’s, and increased sales of Environmental Testing and Simulation Systems, Sterilization Systems, and our ADMS line of products to Domestic customers. Given the current progress made on U.S. Government contracts in the Company’s sales backlog, coupled with significant fiscal 2015 International bookings and the recent award of multiple International contracts totaling $45.4 million, the Company anticipates that although sales to the U.S. Government will remain steady, the concentration of sales to the U.S. Government will continue to lessen in fiscal 2016.

Gross Profit

Gross profit for fiscal 2015 was $7.9 million compared to $14.6 million in fiscal 2014, a decrease of $6.7 million, or 46.1%. The significant decrease in gross profit was a combination of both lower net sales and lower gross profit margin percentage due to inefficiencies as a result of additional out-of-scope work required on several contracts, for some of which we are pursuing recoveries. On April 24, 2014, we reached a favorable settlement agreement on the first of these recoveries that partially offset the effects of the additional work during fiscal 2014. Further, the Company is now well into the testing phase with one of these contracts, and will shortly be in testing phase with the other. Gross profit margin as a percentage of net sales decreased to 21.0% in fiscal 2015 compared to 30.2% in fiscal 2014.

Operating Expenses

Operating expenses, including sales and marketing, general and administrative, and research and development, for fiscal 2015 were $12.7 million, an increase of $0.6 million, or 4.9%, compared to $12.1 million for fiscal 2014. This increase is the combined result of an increase in commissions expense as the concentration of net sales shifts away from U.S. Government, an increase in certain reserves related to ETC-PZL, an increase in the vacation accrual due to a policy change, and increase in legal fees associated primarily with the aforementioned recovery effort offset in part, by an on-going effort to reduce non-revenue generating expenses and a decrease in research and development expense due to increased grant payments to offset expenses and more research and development employees being assigned to specific contracts; thus, expenses related to these employees were included in cost of sales in fiscal 2015.

Interest Expense, Net

Interest expense, net, for fiscal 2015 was $0.7 million compared to $0.8 million in fiscal 2014, a decrease of $0.1 million, or 7.8%, due primarily to a lower level of bank borrowing throughout fiscal 2015 as a whole compared to fiscal 2014.

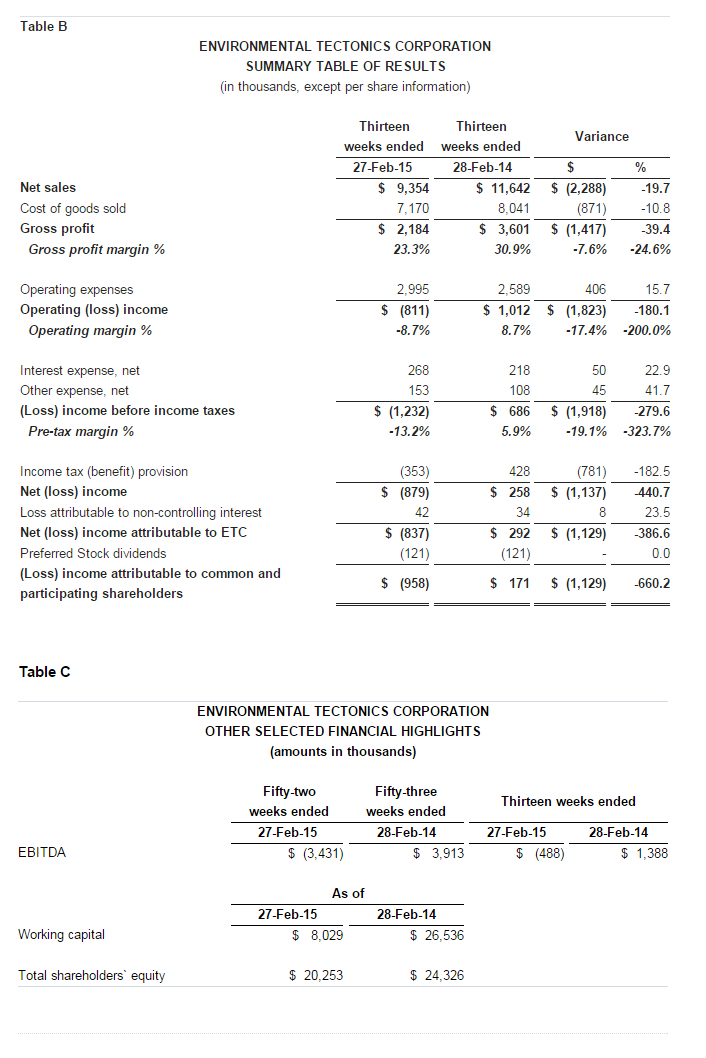

Fiscal 2015 Fourth Quarter Results of Operations

Net (Loss) Income Attributable to ETC

Net loss attributable to ETC was $0.9 million, or $0.06 diluted loss per share, in the 2015 fourth quarter, compared to $0.2 million of net income attributable to ETC during the 2014 fourth quarter, or $0.01 diluted earnings per share. The $1.1 million variance reflects a decrease in income before income taxes of $1.9 million due to a $1.4 million decrease in gross profit resulting from a combination of lower net sales and lower gross profit margin percentage, as well as a $0.4 million increase in operating expenses. The $1.9 million decrease in income before income taxes was offset, in part, by a $0.8 million variance between the income tax benefit recorded in the 2015 fourth quarter and the income tax expense recorded in the 2014 fourth quarter.

Net Sales

Net sales for the 2015 fourth quarter were $9.4 million, a decrease of $2.3 million, or 19.7%, compared to the 2014 fourth quarter. The reduction reflects decreased sales in general to International customers and decreased sales of Sterilization Systems to Domestic customers, offset in part, by increased ATS sales to the U.S. Government due primarily to an order for five (5) GYRO IPT II’s. Given the current progress made on U.S. Government contracts in the Company’s sales backlog, coupled with significant fiscal 2015 International bookings and the recent award of multiple International contracts totaling $45.4 million, the Company anticipates that although sales to the U.S. Government will remain steady, the concentration of sales to the U.S. Government will continue to lessen in fiscal 2016.

Gross Profit

Gross profit for the 2015 fourth quarter decreased by $1.4 million, or 39.4%, compared to the 2014 fourth quarter. The significant decrease in gross profit was a combination of both lower net sales and lower gross profit margin percentage due to inefficiencies as a result of additional out-of-scope work required on several contracts, for some of which we are pursuing recoveries. On April 24, 2014, we reached a favorable settlement agreement on the first of these recoveries that partially offset the effects of the additional work during the 2014 fourth quarter. Further, the Company is now well into the testing phase with one of these contracts, and will shortly be in testing phase with the other. Gross profit margin as a percentage of net sales decreased to 23.3% in the 2015 fourth quarter compared to 30.9% in the 2014 fourth quarter.

Operating Expenses

Operating expenses, including sales and marketing, general and administrative, and research and development, for the 2015 fourth quarter were $3.0 million, an increase of $0.4 million, or 15.7%, compared to $2.6 million for the 2014 fourth quarter. This increase is primarily the result of an increase in certain reserves related to ETC-PZL, offset in part, by an on-going effort to reduce non-revenue generating expenses and a decrease in research and development expense due to increased grant payments to offset expenses and more research and development employees being assigned to specific contracts; thus, expenses related to these employees were included in cost of sales in the 2015 fourth quarter.

Interest Expense, Net

Interest expense, net, for the 2015 fourth quarter was $268 thousand compared to $218 thousand in the 2014 fourth quarter, an increase of $50 thousand, or 22.9%, due to the combined effect of a higher level of bank borrowing and a higher interest rate throughout the 2015 fourth quarter compared to the 2014 fourth quarter.

Cash Flows from Operating, Investing, and Financing Activities

During fiscal 2015, as a result of the significant net loss and a decrease in customer deposits, offset in part, by a decrease in costs and estimated earnings in excess of billings on uncompleted long-term percentage-of-completion contracts, the Company used $0.5 million of cash in operating activities compared to $0.6 million of cash used in operating activities in fiscal 2014.

Cash used for investing activities primarily relates to funds used for capital expenditures in property, plant, and equipment and software development. The Company’s fiscal 2015 investing activities used $1.5 million, which consisted primarily of equipment and software enhancements for our ATFS technology and UPRT capabilities, and costs to upgrade CIS demonstration equipment and existing information technology systems. This is an increase of $0.1 million from cash used in investing activities in fiscal 2014.

The Company’s financing activities generated $1.6 million during fiscal 2015 as compared to $0.1 million in fiscal 2014. The principal use of cash was $1.7 million of payments on the Term Loan. These were offset by $0.9 million in borrowings under the Company’s various lines of credit and a $2.4 million reduction in restricted cash.

Notice of Annual Meeting of Shareholders

The Annual Meeting will be held at the Crowne Plaza Philadelphia – Bucks County in Trevose (Feasterville) located at 4700 E. Street Rd, Trevose, PA, 19053, USA on Wednesday, July 15, 2015, at 10:00 a.m. for the following purposes:

- To elect seven (7) Directors to serve on the Board of Directors until ETC’s 2016 Annual Meeting of Shareholders and until their successors are elected.

- To ratify the appointment of McGladrey LLP as the independent registered public accounting firm for ETC for the fiscal year ending February 26, 2016.

- To transact such other business as may properly come before the meeting and any adjournment of the meeting.

The Board of Directors has fixed the close of business on May 28, 2015 as the record date for the determination of shareholders entitled to notice of and to vote at the Annual Meeting.

To vote your shares at the Annual Meeting, you or your designated proxy must be present at the Annual Meeting.

A copy of the Company’s 2015 Annual Report is available within the Investors section of ETC’s website on our Shareholders Materials page.

Forward-looking Statements

This news release contains forward-looking statements, which are based on management's expectations and are subject to uncertainties and changes in circumstances. Words and expressions reflecting something other than historical fact are intended to identify forward-looking statements, and these statements may include terminology such as "may", "will", "should", "expect", "plan", "anticipate", "believe", "estimate", "future", "predict", "potential", "intend", or "continue", and similar expressions. We base our forward-looking statements on our current expectations and projections about future events or future financial performance. Our forward-looking statements are subject to known and unknown risks, uncertainties and assumptions about ETC and its subsidiaries that may cause actual results to be materially different from any future results implied by these forward-looking statements. We caution you not to place undue reliance on these forward-looking statements.