ETC Announces Fiscal 2014 Second Quarter Results

SOUTHAMPTON, PA, USA, October 14, 2013 – Environmental Tectonics Corporation (OTC Pink: ETCC) (“ETC” or the “Company”) today reported its financial results for its fiscal 2014 second quarter ended August 30, 2013.

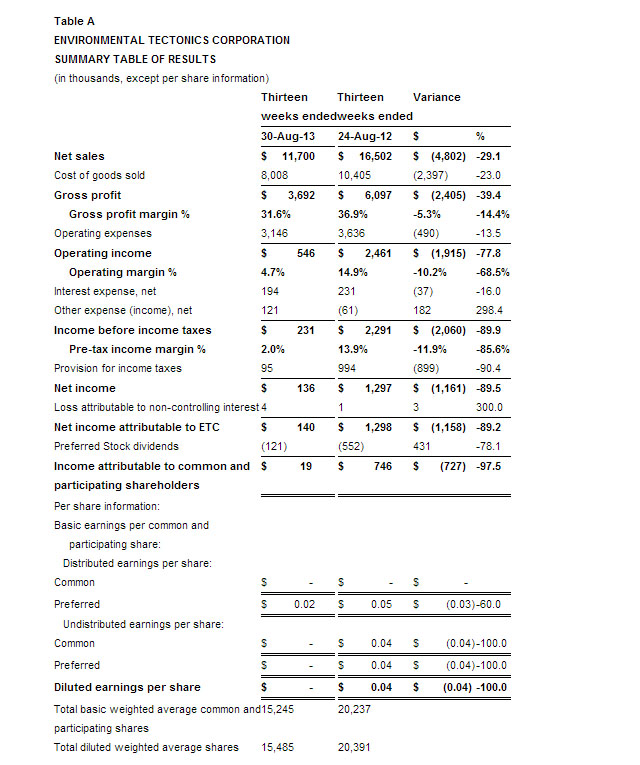

Fiscal 2014 Second Quarter Results of Operations:

Net Income Attributable to ETC

Net income attributable to ETC was $140 thousand, or $0.00 diluted earnings per share, in the 2014 second quarter, compared to $1.3 million or $0.04 diluted earnings per share, during the 2013 second quarter, representing a decrease of $1.2 million, or 89.2%. The decrease in net income attributable to ETC reflects a decrease in income before income taxes of $2.1 million due primarily to a $2.4 million decrease in gross profit, resulting from a combination of both lower net sales and lower gross profit margin percentage, offset in part, by a $0.5 million decrease in operating expenses, resulting from an on-going effort to reduce non-revenue generating expenses.

Net Sales

Net sales in the 2014 second quarter were $11.7 million, a decrease of $4.8 million, or 29.1%, compared to 2013 second quarter net sales of $16.5 million. The decrease reflects decreased ATS sales to the U.S. Government and decreased sales of sterilizers and environmental testing and simulation devices to Domestic customers. Given the current progress made on U.S. Government contracts in the Company’s sales backlog, the Company anticipates the concentration of sales to the U.S. Government will continue to lessen in fiscal 2014.

Gross Profit

Gross profit for the 2014 second quarter was $3.7 million compared to $6.1 million in the 2013 second quarter, a decrease of $2.4 million, or 39.4%. The significant decrease in gross profit was a combination of both lower net sales and lower gross profit margin percentage due to inefficiencies as a result of additional work required on several contracts.

Operating Expenses

Operating expenses, including sales and marketing, general and administrative, and research and development, for the 2014 second quarter were $3.1 million, a decrease of $0.5 million, or 13.5%, compared to $3.6 million for the 2013 second quarter. The decrease is primarily the result of an on-going effort to reduce non-revenue generating expenses, offset in part, by an increase in research and development expenses.

Interest Expense, Net

Interest expense, net, for the 2014 second quarter was $194 thousand compared to $231 thousand in the 2013 second quarter, a decrease of $37 thousand despite a higher level of bank borrowing due primarily to the results of the 2012 Financial Restructuring.

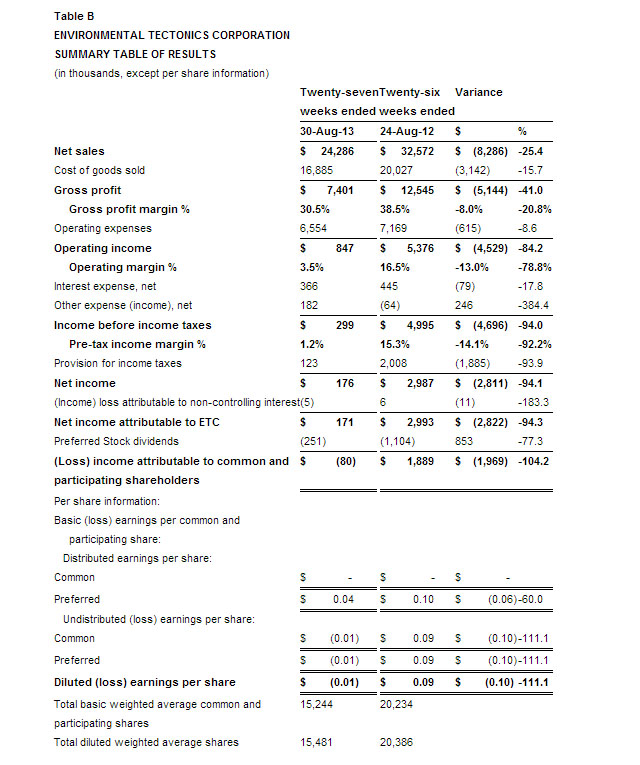

Fiscal 2014 First Half Results of Operations:

Net Income Attributable to ETC

Net income attributable to ETC was $171 thousand, or ($0.01) diluted loss per share, in the 2014 first half, compared to $3.0 million or $0.09 diluted earnings per share, during the 2013 first half, representing a decrease of $2.8 million, or 94.3%. The decrease in net income attributable to ETC reflects a decrease in income before income taxes of $4.7 million due primarily to a $5.1 million decrease in gross profit, resulting from a combination of both lower net sales and lower gross profit margin percentage, offset in part, by a $0.6 million decrease in operating expenses, resulting from an on-going effort to reduce non-revenue generating expenses.

Net Sales

Net sales in the 2014 first half were $24.3 million, a decrease of $8.3 million, or 25.4%, compared to 2013 first half net sales of $32.6 million. The decrease reflects decreased ATS sales to the U.S. Government and decreased sales of sterilizers and environmental testing and simulation devices to Domestic customers, offset in part, by increased sales within nearly all business units to International customers. Given the current progress made on U.S. Government contracts in the Company’s sales backlog, the Company anticipates the concentration of sales to the U.S. Government will continue to lessen in fiscal 2014.

Gross Profit

Gross profit for the 2014 first half was $7.4 million compared to $12.5 million in the 2013 first half, a decrease of $5.1 million, or 41.0%. The significant decrease in gross profit was a combination of both lower net sales and lower gross profit margin percentage due to increased costs as a result of damage to one of our devices associated with a U.S. Government contract during the testing phase and inefficiencies as a result of additional work required on several other contracts.

Operating Expenses

Operating expenses, including sales and marketing, general and administrative, and research and development, for the 2014 first half were $6.6 million, a decrease of $0.6 million, or 8.6%, compared to $7.2 million for the 2013 first half. The decrease is primarily the result of an on-going effort to reduce non-revenue generating expenses, offset in part, by an increase in research and development expenses.

Interest Expense, Net

Interest expense, net, for the 2014 first half was $366 thousand compared to $445 thousand in the 2013 first half, a decrease of $79 thousand despite a higher level of bank borrowing due primarily to the results of the 2012 Financial Restructuring.

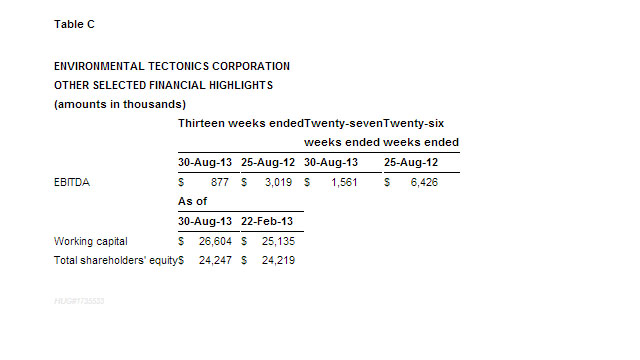

Cash Flows from Operating, Investing, and Financing Activities:

During the 2014 first half, as a result of an increase in costs and estimated earnings in excess of billings on uncompleted long-term percentage of completion (“POC”) contracts and a decrease in accounts payable, the Company used $3.2 million of cash in operating activities compared to $4.3 million of cash provided by operating activities in the 2013 first half. Under POC revenue recognition, these accounts represent the timing differences of spending on production activities versus collecting on long-term contracts.

Cash used for investing activities primarily relates to funds used for capital expenditures in equipment and software development. The Company’s investing activities used $0.6 million in the 2014 first half compared to $0.8 million in the 2013 first half.

The Company’s financing activities provided $2.5 million of cash in the 2014 first half, which primarily reflected borrowings under the Company’s various lines of credit, and was offset, in part, by payments on the Term Loan. In the 2013 first half, net cash used in financing activities totaled $3.9 million, primarily for repayments under the line of credit and dividends paid on Preferred Stock.

Amendment to the September 28, 2012 Loan Agreement:

On October 11, 2013, the Company entered into an amendment to the September 28, 2012 Loan Agreement that provided for, among other things, the following:

- The Company’s Line of Credit with PNC Bank was increased from $15.0 million to $15.5 million.

- Availability under the Line of Credit was increased by approximately $1.2 million as a currently outstanding letter of credit supporting bid bond shall no longer reduce availability under the Line of Credit so long as it remains outstanding.

- The Term Loan, which is currently guaranteed by H.F. Lenfest (“Mr. Lenfest”), a major shareholder and member of the Board of Directors, through March 31, 2015, will be collateralized by Mr. Lenfest through that period, or until the Company’s Operating Leverage Ratio using all Senior Funded Debt in place of Adjusted Senior Funded Debt is less than 3.00 to 1, whichever occurs first. Adjusted Senior Funded Debt is defined as the sum of Senior Funded Debt minus the then outstanding principal amount of the Term Loan, and will be used for calculating Operating Leverage Ratio while the collateral is in place.

- Until such time the Company’s Fixed Charge Coverage Ratio is at least 1.10 to 1, the Company cannot declare or pay any dividends on or make any distribution with respect to any class of its Preferred Stock, or purchase, redeem, retire, or otherwise acquire any such Preferred Stock.

- The Company received a waiver as of the quarter ending August 30, 2013 for exceeding the permitted maximum Operating Leverage Ratio of 3.00 to 1 under the September 28, 2012 Loan Agreement and December 19, 2012 Export Import Loan Agreement. Going forward, ETC must maintain an Operating Leverage Ratio (i.e., ratio of Adjusted Senior Funded Debt to EBITDA, which is defined as earnings before interest, taxes, depreciation, and amortization) of less than 3.50 to 1 from November 29, 2013 through February 28, 2014. This ratio will reduce to 3.25 to 1 from March 1, 2014 through May 30, 2014, will further reduce to 3.00 to 1 on May 31, 2014, and will remain at that level at all times thereafter.

- ETC must maintain as of the end of each fiscal quarter, on a rolling four quarters basis, a Fixed Charge Coverage Ratio (i.e. ratio of EBITDA, increased by an amount equal to the EBITDA Addback specified for such quarter end date, divided by the sum of the defined fixed charges) of at least 1.00 to 1 from November 29, 2013 through August 29, 2014. This ratio will increase to 1.10 to 1 on August 30, 2014, and will remain at that level at all times thereafter.

- Effective as of the date of this amendment, the interest rate on both the Line of Credit Note and the Term Loan Note will be based on the PNC Daily Libor Rate plus a margin of 3.00%.

Financial Tables Follow

Forward-looking Statements

This news release contains forward-looking statements, which are based on management's expectations and are subject to uncertainties and changes in circumstances. Words and expressions reflecting something other than historical fact are intended to identify forward-looking statements, and these statements may include terminology such as "may", "will", "should", "expect", "plan", "anticipate", "believe", "estimate", "future", "predict", "potential", "intend", or "continue", and similar expressions. We base our forward-looking statements on our current expectations and projections about future events or future financial performance. Our forward-looking statements are subject to known and unknown risks, uncertainties and assumptions about ETC and its subsidiaries that may cause actual results to be materially different from any future results implied by these forward-looking statements. We caution you not to place undue reliance on these forward-looking statements.