ETC Announces Fiscal 2026 Third Quarter Results

SOUTHAMPTON, PA, USA, January 13, 2026 – Environmental Tectonics Corporation (OTCID: ETCC) (“ETC” or the “Company”) today reported its financial results for the thirteen week period ended November 28, 2025 (the “2026 fiscal third quarter”)

Robert L. Laurent, Jr., ETC’s Chief Executive Officer and President stated, “Sales declined in the third fiscal quarter as we have been executing against several large contracts, which are in the final phase of completion. However, we are pleased with the 12% increase in ETC sales backlog at the end of 2026 fiscal third quarter to $69.7 million as compared to $62.3 million at the end of the 2026 second fiscal quarter. This increase was driven by $20.0 million in new contract awards in 2026 fiscal third quarter. The increased sales backlog and the large pipeline of opportunities positions ETC for continued success.

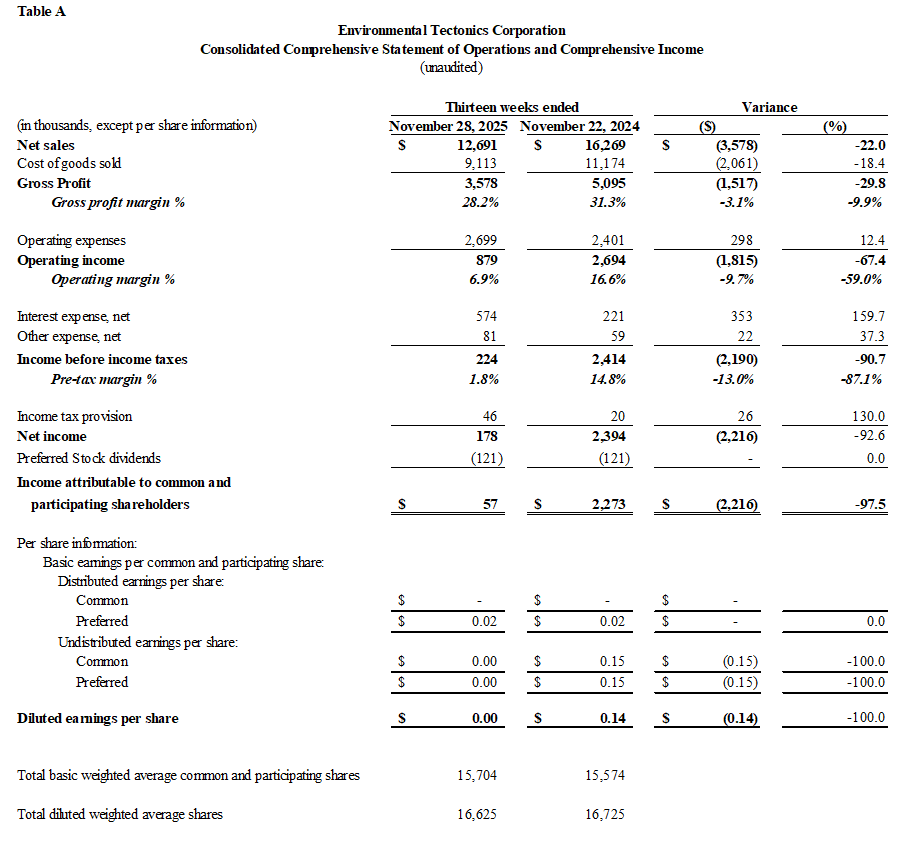

Fiscal 2026 Third Quarter Results of Operations

Net Income

Net income was $0.2 million, or $0.00 diluted earnings per share, in the 2026 fiscal third quarter, compared to net income of $2.4 million during the 2025 fiscal third quarter, equating to $0.14 diluted earnings per share. The $2.2 million unfavorable variance is primarily attributable to a $3.6 million decrease in net sales, a 3.1% decrease in gross profit margin percentage, a $0.3 million increase in operating expenses as well as a $0.4 million increase in interest expense, net.

Net Sales

Net sales in the 2026 fiscal third quarter were $12.7 million, a decrease of $3.6 million, or 22.0%, compared to 2025 fiscal third quarter net sales of $16.3 million. The decrease in net sales was driven by a $3.1 million, or 48.6%, decrease in sterilizer systems, a $0.5 million, or 35.5% decrease in environmental testing and simulation systems, and a $0.3 million, or 39.1% decrease in service and spare parts net sales in the 2026 fiscal third quarter as compared to 2025 fiscal third quarter net sales. The decrease in net sales was slightly offset by a $0.4 million, or 5.6% increase in aeromedical training solutions sales. Bookings in the 2026 fiscal third quarter were $20.0 million as compared to $9.3 million in the 2025 fiscal third quarter. Bookings in the 2026 fiscal third quarter were driven by $10.8 million of Aerospace Solutions orders and $7.6 million of environmental testing and simulation systems orders.

Gross Profit

Gross profit for the 2026 fiscal third quarter was $3.6 million, as compared to $5.1 million in the 2025 fiscal third quarter, a decrease of $1.5 million, or 29.8%. The decrease in gross profit was due to the decrease in sales and a decrease in the gross profit margin percentage by 3.1%, from 31.3% in the 2025 fiscal third quarter to 28.2% in the 2026 fiscal third quarter. The decrease in gross profit margin as a percentage of sales was a direct result of the increase in revenue related to the construction of an aeromedical center building within the ATS business unit, which yields a lower margin than ETC’s core businesses as the work is being performed by a sub-contracted construction firm. Excluding the impact of the lower margins realized from the aeromedical center building revenue, gross profit margin was 35.1% for the third fiscal quarter 2026 as compared to 33.9% for third fiscal quarter 2025. The increase in gross profit margin, excluding the aeromedical center building revenue, is attributable to positive job cost revisions in both the Aerospace and CIS business segments in the 2026 fiscal third fiscal quarter.

Operating Expenses

Operating expenses, including sales and marketing, general and administrative, and research and development, for the 2026 fiscal third quarter were $2.7 million, an increase of $0.3 million, or 12.4%, compared to $2.4 million for the 2025 fiscal third quarter. The increase in operating expenses was due primarily to higher research and development costs in the 2026 fiscal third quarter compared to the 2025 fiscal third quarter.

Interest Expense, Net

Interest expense, net, for the 2026 fiscal third quarter was $0.6 million compared to $0.2 million in the 2025 fiscal third quarter, an increase of $0.4 million, or 159.7%, reflecting increased borrowing attributable to the leaseback of the demonstration equipment and finished goods inventory in fiscal 2025 fourth quarter and fiscal 2026 second quarter, respectively.

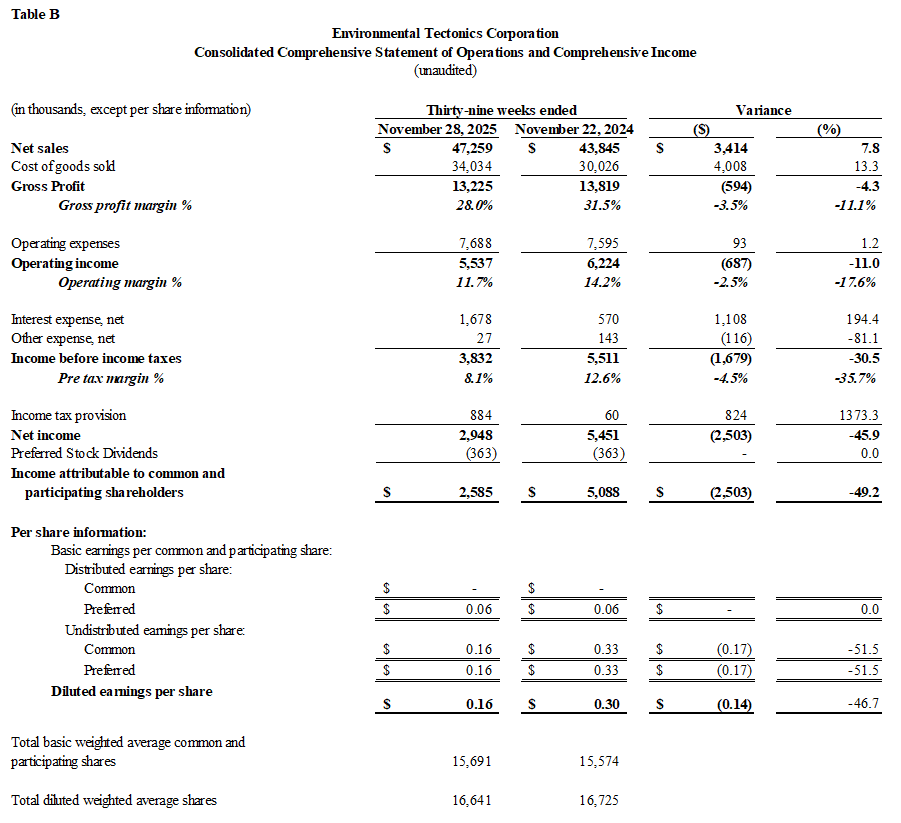

2026 Fiscal Three Quarters Results of Operations

Net Income

Net income was $2.9 million, or $0.16 diluted earnings per share, in the 2026 fiscal first three quarters, compared to net income of $5.5 million during the 2025 fiscal first three quarters, equating to $0.30 diluted earnings per share. The $2.5 million decrease is a result of a $0.6 million, or 4.3% decrease in gross profit attributable to a 3.5% reduction in gross profit margin percentage; a $1.1 million increase in interest expense, net, and a $0.8 million increase in non-cash tax expense.

Net Sales

Net sales in the 2026 fiscal first three quarters were $47.3 million, an increase of $3.4 million, or 7.8%, compared to 2025 fiscal first three quarters net sales of $43.8 million. The increase in net sales was driven by a $7.8 million, or 35.7%, increase in aeromedical training solutions. The increase in sales was partially offset by a $3.0 million, or 19.2% decrease in sterilizer systems, an $0.8 million, or 26.3% decrease in ADMS, and a $0.5 million, or 23.7% decrease in environmental testing and simulation systems net sales in 2026 fiscal first three quarters as compared to 2025 fiscal first three quarters.

Gross Profit

Gross profit for the 2026 fiscal first three quarters was $13.2 million compared to $13.8 million in the 2025 fiscal first three quarters, a decrease of $0.6 million, or 4.3%. The decrease in gross profit was attributable to a decrease in gross margin percentage of 3.5% from 31.5% in the 2025 fiscal first three quarters to 28.0% in the 2026 fiscal first three quarters. The decrease in gross profit margin as a percentage of sales was a direct result of the increase in revenue related to the construction of an aeromedical center building within the ATS business unit, which yields a lower margin than ETC’s core businesses as the work is being performed by a sub-contracted construction firm. Excluding the impact of the lower margins realized from the aeromedical center building revenue, gross profit margin was 35.0% for fiscal 2026 first three quarters as compared to 33.0% for 2025 fiscal first three quarters. The increase in gross profit margin, excluding the aeromedical center building revenue, is attributable to positive job cost revisions in both the Aerospace and CIS business segments in the 2026 fiscal first three quarters.

Operating Expenses

Operating expenses, including sales and marketing, general and administrative, and research and development, for the 2026 fiscal first three quarters were $7.7 million, an increase of $0.1 million, or 1.2%, compared to $7.6 million for the 2025 fiscal first three quarters. The increase in operating expenses was primarily due to increased selling expenses related to higher sales offset slightly by a decrease in research and development expenses.

Interest Expense, Net

Interest expense, net for the 2026 fiscal first three quarters was $1.7 million, or 194.4% compared to interest expense, net of $0.6 million for the 2025 fiscal first three quarters, an unfavorable variance of $1.1 million. The unfavorable variance was primarily attributable to an increase in borrowing attributable to the leaseback of the demonstration equipment in 2025 fiscal fourth quarter and finished goods inventory in the 2026 fiscal second quarter.

Other Expense, Net

Other expense, net decreased by $0.1 million, or 81.1% for the 2026 fiscal first three quarters as compared to the 2025 fiscal first three quarters attributable to a 0.1 million increase in other income, net from ETC-PZL.

Cash Flows from Operating, Investing, and Financing Activities

During the 2026 fiscal first three quarters, the Company used $0.7 million of cash for operating activities, due primarily to an increase in accounts receivable and prepaid assets and a decrease in accounts payable, trade, slightly offset by an increase in net income, a decrease in contract assets, inventory and deferred tax assets and an increase in contract liabilities, as compared to using $4.5 million during the 2025 fiscal first three quarters.

Cash used for investing activities was $0.3 million during the 2026 fiscal first three quarters which primarily related to funds used for capital expenditures of equipment and software development as compared to $0.3 million used for investing activities during the fiscal first three quarters of 2025.

The Company’s financing activities included repayments of $1.3 million during the fiscal first three quarters of 2026 under the Company’s credit facilities slightly offset by $0.2 million in proceeds from the issuance of common stock from options exercised as compared to borrowing of $4.0 million during the 2025 fiscal first three quarters under the Company’s credit facilities.

Financial Table Follows

Forward-looking Statements

This news release contains forward-looking statements, which are based on management's expectations and are subject to uncertainties and changes in circumstances. Words and expressions reflecting something other than historical fact are intended to identify forward-looking statements, and these statements may include terminology such as "may", "will", "should", "expect", "plan", "anticipate", "believe", "estimate", "future", "predict", "potential", "intend", or "continue", and similar expressions. We base our forward-looking statements on our current expectations and projections about future events or future financial performance. Our forward-looking statements are subject to known and unknown risks, uncertainties and assumptions about ETC and its subsidiaries that may cause actual results to be materially different from any future results implied by these forward-looking statements. We caution you not to place undue reliance on these forward-looking statements.