ETC Announces Fiscal 2024 First Quarter Results

SOUTHAMPTON, PA, USA, July 13, 2023 – Environmental Tectonics Corporation (OTC Pink: ETCC) (“ETC” or the “Company”) today reported its financial results for the thirteen week period ended May 26, 2023 (the “2024 first fiscal quarter”).

Robert L. Laurent, Jr., ETC’s Chief Executive Officer and President stated, “We are pleased with the 31% increase in ETC sales vs. prior year driven by a 77% increase in sales vs. prior year within our Sterilizers business and a 108% increase in sales of Aeromedical Training Solutions products vs. prior year. ETC finished the quarter with a backlog of approximately $100 million, which we anticipate driving increases in production, sales and profitability.”

Fiscal 2024 First Quarter Results of Operations

Net Income (Loss) Attributable to ETC

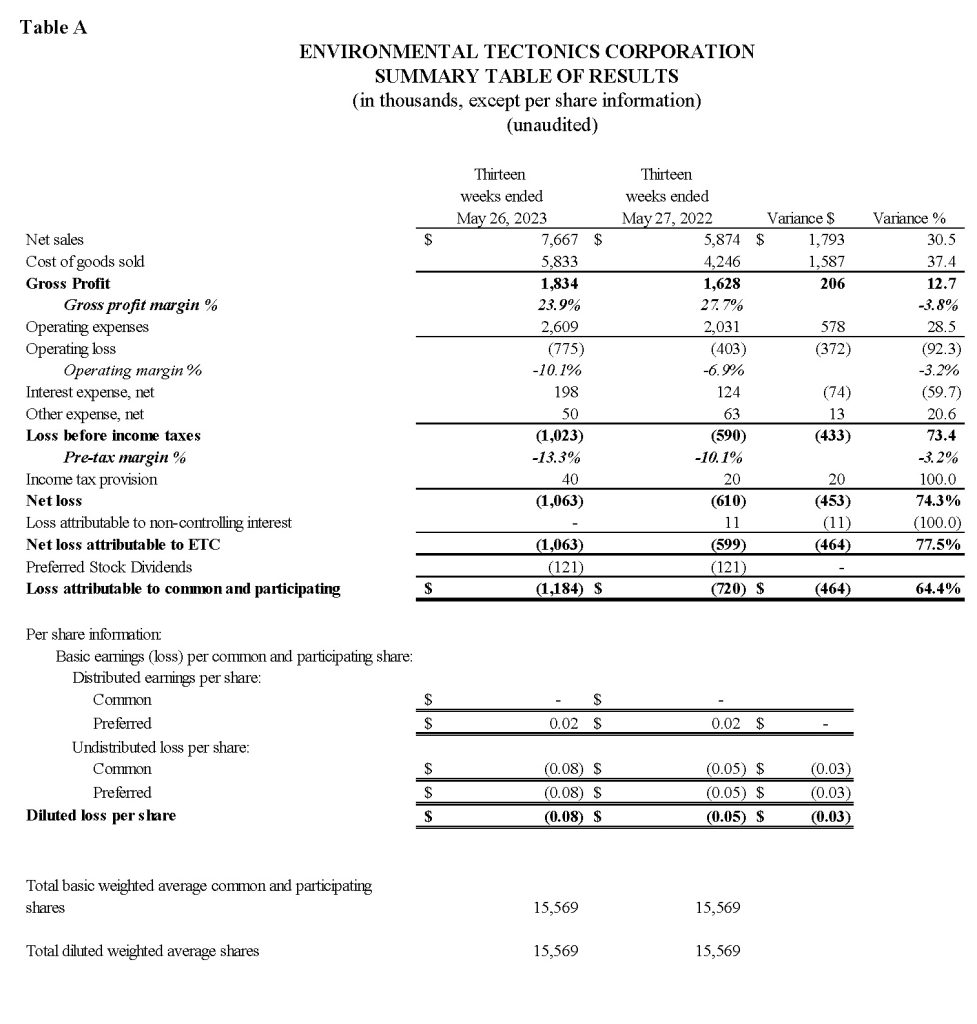

Net loss attributable to ETC was $1.1 million, or ($0.08) diluted loss per share, in the 2024 first fiscal quarter, compared to net loss attributable to ETC of $0.6 million during the thirteen week period ended May 27, 2022 (the “2023 first fiscal quarter”), equating to ($0.05) diluted loss per share. The $0.5 million variance is due primarily to the combined effect of a 3.8% decrease in gross profit margin percentage and a $0.6 million increase in operating expense partially offset by a $1.8 million increase in revenue.

Net Sales

Net sales in the 2024 first fiscal quarter were $7.7 million, an increase of $1.8 million, or 31%, compared to 2023 first fiscal quarter net sales of $5.9 million. The increase in net sales was mainly a result of a larger backlog entering fiscal year 2024. The Aerospace sales in 2024 first fiscal quarter accounted for 51% of overall sales, compared to 40% in first fiscal quarter 2023. Further, international sales increased to 68% of total sales in 2024 first fiscal quarter from 29% in the 2023 first fiscal quarter. Bookings in the 2024 first fiscal quarter were $4.3 million, which were driven by $1.5 million and $0.8 million of ATS and ETSS (each as defined below) orders, respectively.

Gross Profit

Gross profit for the 2024 first fiscal quarter of $1.8 millionincreased slightlycompared to $1.6 million in the 2023 first fiscal quarter, while gross profit margin percentage decreased by 3.8%. The change in gross profit was a result of higher revenue of $1.8 million. Gross profit margins were negatively affected during the quarter as the Company began to ramp up employment to handle the significant increase in backlog.

Operating Expenses

Operating expenses, including sales and marketing, general and administrative, and research and development, for the 2024 first fiscal quarter were $2.6 million, an increase of $0.6 million, or 29%, compared to $2.0 million for the 2023 first fiscal quarter. The increase in operating expenses was due primarily to higher selling expenses, primarily a result of increased expenses related to higher revenue and overall employee related costs as the company began to ramp up employment to handle the significant increase in backlog.

Other Expenses (Income), Net

Other expenses, net was $0.2 million for the 2024 first fiscal quarter and the 2023 first fiscal quarter, respectively.

Cash Flows from Operating, Investing, and Financing Activities

During the 2024 first fiscal quarter, due primarily from the increase in contract assets and decrease in contract liabilities and the net loss for the period, the Company used $5.1 million of cash for operating activities compared to $1.5 million during the 2023 first fiscal quarter.

Cash used for investing activities primarily relates to funds used for capital expenditures of equipment and software development as well as the purchase of the final 5% of ETC-PZL Aerospace Industries Sp. z o.o. (“ETC-PZL”), our 100%-owned subsidiary in Warsaw, Poland. The Company’s investing activities used $0.2 million during the 2024 first fiscal quarter compared to $0.1 million during the 2023 first fiscal quarter.

The Company’s financing activities provided $4.3 million of cash during the 2024 first fiscal quarter from borrowings under the Company’s credit facility compared to providing $1.1 million of cash during the 2023 first fiscal quarter under the Company’s credit facility.

Financial Tables Follow

Forward-looking Statements

This news release contains forward-looking statements, which are based on management's expectations and are subject to uncertainties and changes in circumstances. Words and expressions reflecting something other than historical fact are intended to identify forward-looking statements, and these statements may include terminology such as "may", "will", "should", "expect", "plan", "anticipate", "believe", "estimate", "future", "predict", "potential", "intend", or "continue", and similar expressions. We base our forward-looking statements on our current expectations and projections about future events or future financial performance. Our forward-looking statements are subject to known and unknown risks, uncertainties and assumptions about ETC and its subsidiaries that may cause actual results to be materially different from any future results implied by these forward-looking statements. We caution you not to place undue reliance on these forward-looking statements.