ETC Announces Fiscal 2023 First Quarter Results

SOUTHAMPTON, PA, USA, July 8, 2022 – Environmental Tectonics Corporation (OTC Pink: ETCC) (“ETC” or the “Company”) today reported its financial results for the thirteen week period ended May 27, 2022 (the “2023 first quarter”).

Robert L. Laurent, Jr., ETC’s Chief Executive Officer and President stated, “We are pleased with the 32% increase in sales vs. prior year within our Commercial/Industrial Systems business and with the 55% increase in sales of Advanced Disaster Management System products. Though Aircrew Training Solutions sales were down from the prior year, the sales pipeline remains strong.”

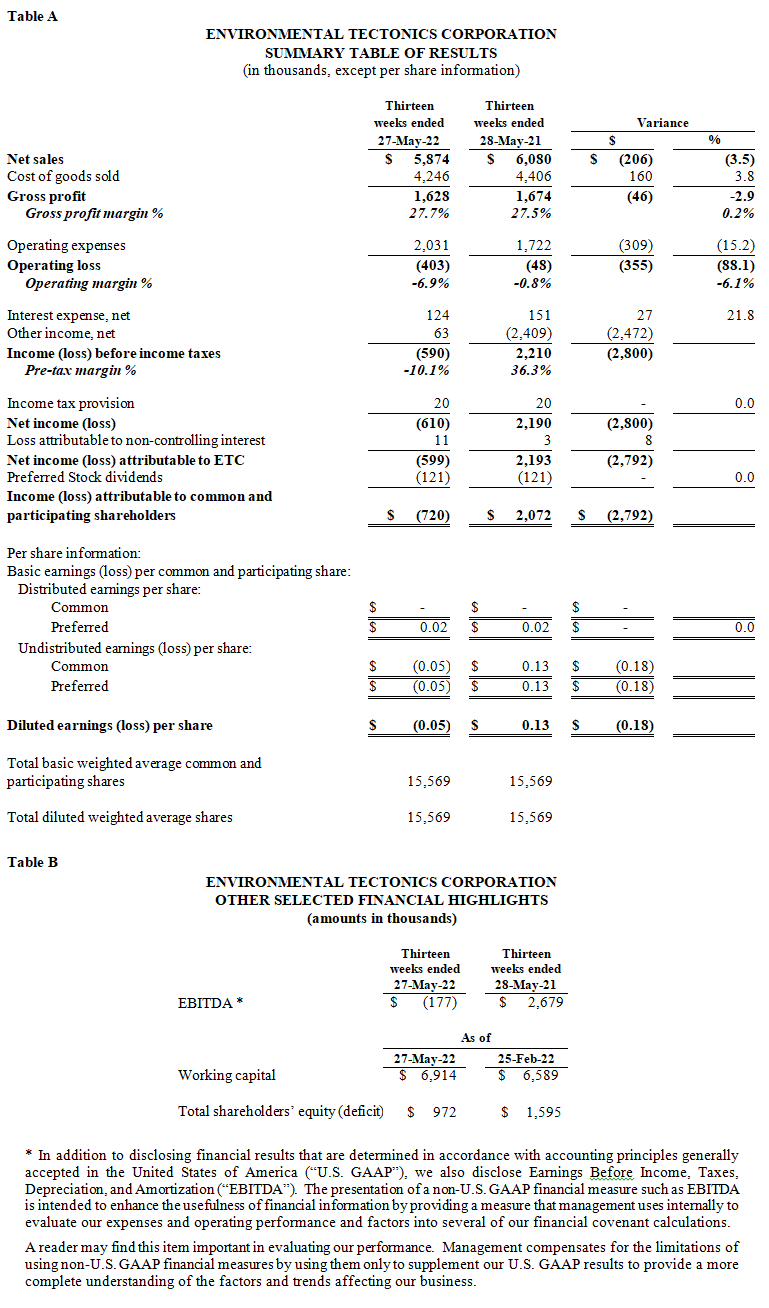

Fiscal 2023 First Quarter Results of Operations

Net Income (Loss) Attributable to ETC

Net loss attributable to ETC was $0.6 million, or ($0.05) diluted loss per share, in the 2023 first fiscal quarter, compared to net income attributable to ETC of $2.2 million during the 2022 first quarter, equating to $0.13 diluted loss per share. The $2.8 million variance is due primarily to the combined effect of a $2.4 million increase in other income in 2022 related to the PPP loan forgiveness, along with increases in operating expenses of $0.3 million and slight reduction in overall revenue.

Net Sales

Net sales in the 2023 first fiscal quarter were $5.87 million, a decrease of only $0.2 million, or (3.5%), compared to 2022 first quarter net sales of $6.1 million. The decrease in net sales was mainly a result of the low backlog entering fiscal year 2023. The backlog, combined with the continued delays we are experiencing with the overall supply chain,

resulted in a small reduction in first quarter revenues. Aerospace sales in 2023 first fiscal quarter accounted for 40% of overall sales, compared to 56% in first fiscal quarter 2022. Further, domestic sales of 60% in 2023 first fiscal quarter were increased from 44% in first fiscal quarter of 2022. Bookings in the 2023 first fiscal quarter were $2.2 million, which were driven by $1.2 of Environmental orders.

Gross Profit

Gross profit for the 2023 first fiscal quarter of $1.6 million decreased slightly compared to $1.7 million in the 2022 first fiscal quarter, while gross profit margin increased by 0.2%. The change in gross profit was a result of the slight revenue change. There were no specific business unit drivers in the first quarter that affected the gross profit in a significant manner.

Operating Expenses

Operating expenses, including sales and marketing, general and administrative, and research and development, for the 2023 first quarter were $2.0 million, an increase of $0.3 million, or 15.2%, compared to $1.7 million for the 2022 first quarter. The increase in operating expenses was due primarily to higher general and administrative expenses, primarily a result of increased expenses related to ETC-PZL and overall employee related costs.

Other Expenses (Income), Net

Other expenses, net for the 2023 first fiscal quarter was $0.1 million compared to other income of $2.4 million for the 2022 first fiscal quarter, an unfavorable variance of $2.5 million due to the prior accounting for the forgiveness of the PPP loan in 2022.

Cash Flows from Operating, Investing, and Financing Activities

During the 2023 first quarter, due primarily from the decrease in contract liabilities and the net loss for the period, the Company used $1.5 million of cash for operating activities compared to only $0.1 million during the 2022 first quarter. Under Accounting Standards Codification (“ASC”) 606, accounts such as contract assets and accounts receivable

represent the timing differences of spending on production activities versus the billing and collecting of customer payments.

Cash used for investing activities primarily relates to funds used for capital expenditures of equipment and software development. The Company’s investing activities used $85 thousand during the 2023 first quarter compared to $41 thousand during the 2022 first quarter.

The Company’s financing activities provided $1.1 million of cash during the 2023 first quarter from borrowings under the Company’s credit facility compared to using $1.0 million of cash during the 2022 first quarter under the Company’s credit facility.

Financial Tables Follow

Forward-looking Statements

This news release contains forward-looking statements, which are based on management's expectations and are subject to uncertainties and changes in circumstances. Words and expressions reflecting something other than historical fact are intended to identify forward-looking statements, and these statements may include terminology such as "may", "will", "should", "expect", "plan", "anticipate", "believe", "estimate", "future", "predict", "potential", "intend", or "continue", and similar expressions. We base our forward-looking statements on our current expectations and projections about future events or future financial performance. Our forward-looking statements are subject to known and unknown risks, uncertainties and assumptions about ETC and its subsidiaries that may cause actual results to be materially different from any future results implied by these forward-looking statements. We caution you not to place undue reliance on these forward-looking statements.