ETC Announces Fiscal 2022 First Quarter Results

SOUTHAMPTON, PA, USA, September 3, 2021 – Environmental Tectonics Corporation (OTC Pink: ETCC) (“ETC” or the “Company”) today reported its financial results for the thirteen week period ended May 28, 2021 (the “2022 first quarter”).

Robert L. Laurent, Jr., ETC’s Chief Executive Officer and President stated, “With portions of the global economy beginning to open, we are beginning to see the start of resurgence in ETC’s business as evidenced by the improved results of our 2022 first quarter, during which we received new orders in excess of $10 million. Many of the projects in our international pipeline are also building momentum.”

Fiscal 2022 First Quarter Results of Operations

Net Income (Loss) Attributable to ETC

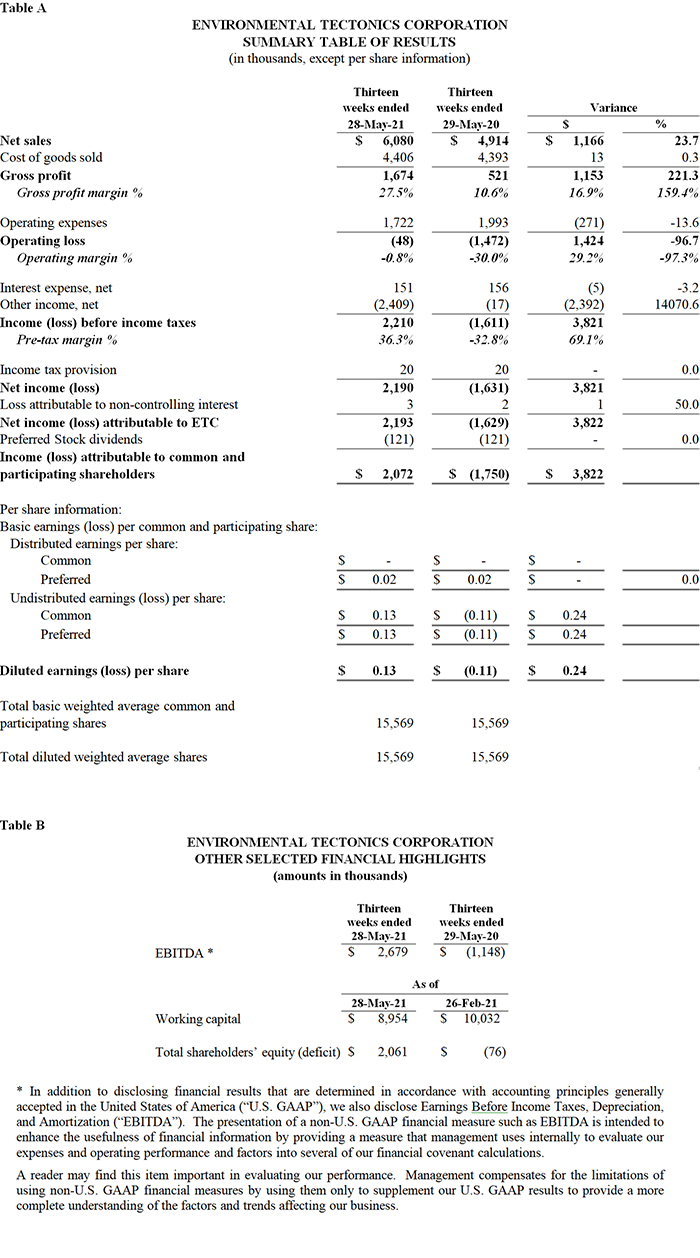

Net income attributable to ETC was $2.2 million, or $0.13 diluted earnings per share, in the 2022 first quarter, compared to a net loss attributable to ETC of $1.6 million during the 2021 first quarter, equating to $0.11 diluted loss per share. The $3.8 million variance is due to the combined effect of a $2.4 million increase in other income, net, a $1.2 million increase in gross profit, and a $0.3 million decrease in operating expenses.

Net Sales

Net sales in the 2022 first quarter were $6.1 million, an increase of $1.2 million, or 23.7%, compared to 2021 first quarter net sales of $4.9 million. The increase in net sales was due primarily to an increase in sales of Sterilizers to Domestic customers. Slightly less than half of the Sterilizer net sales in the 2022 first quarter stemmed from orders booked during the same quarter. Bookings in the 2022 first quarter were $10.2 million, of which $2.8 million were of Sterilizers and $6.0 million were of Aeromedical Training Solutions to a long-term International customer. Lower net sales were generated in the 2021 first quarter due to the combination of a lower backlog entering fiscal 2021 compounded with the effects of the COVID-19 global pandemic, which not only impacted the Company’s ability to generate bookings, especially internationally, but also forced the closure of the Company’s corporate headquarters and main production plant for about one-third of the 2021 first quarter in accordance with Pennsylvania state mandates.

Gross Profit

Gross profit for the 2022 first quarter was $1.7 million compared to $0.5 million in the 2021 first quarter, an increase of $1.2 million, or 221.3%. The increase in gross profit was due to the combined effect of an increase in net sales and an increase in gross profit margin. Gross profit margin as a percentage of net sales increased to 27.5% for the 2022 first quarter compared to 10.6% for the 2021 first quarter primarily due to the recognition in net sales of approximately $1.7 million, or 28.0%, of both 2022 first quarter net sales and the aforementioned $6.0 million International Aeromedical Training Solutions order, which traditionally produce our highest margins. The lower gross profit margin in the 2021 first quarter was a result of the lower net sales noted above not being able to support fixed overhead expenses.

Operating Expenses

Operating expenses, including sales and marketing, general and administrative, and research and development, for the 2022 first quarter were $1.7 million, a decrease of $0.3 million, or 13.6%, compared to $2.0 million for the 2021 first quarter. The decrease in operating expenses was due primarily to lower general and administrative expenses, which included a reduction in headcount and legal fees now that the claim litigation pertaining to a firm fixed-price contract dated June 14, 2010 to build a suite of research altitude chambers at the Wright-Patterson Air Force Base has been settled.

Other Income, Net

Other income, net for the 2022 first quarter was $2.4 million compared to $17 thousand for the 2021 first quarter, a variance of $2.4 million due almost entirely from accounting for the forgiveness of the Paycheck Protection Program (the “PPP”) loan.

Cash Flows from Operating, Investing, and Financing Activities

During the 2022 first quarter, due primarily from the increase in accounts receivable, the increase in prepaid expenses and other current assets, and the decrease in other accrued liabilities, offset, in part by the decrease in contract assets, the Company used $0.1 million of cash for operating activities compared to $2.6 million during the 2021 first quarter. Under Accounting Standards Codification (“ASC”) 606, accounts such as contract assets and accounts receivable represent the timing differences of spending on production activities versus the billing and collecting of customer payments.

Cash used for investing activities primarily relates to funds used for capital expenditures of equipment and software development. The Company’s investing activities used $41 thousand during the 2022 first quarter compared to $14 thousand during the 2021 first quarter.

The Company’s financing activities used $1.0 million of cash during the 2022 first quarter for repayments under the Company’s credit facility compared to providing $3.4 million of cash during the 2021 first quarter with proceeds from the PPP loan and borrowings under the Company’s credit facility.

About ETC

ETC was incorporated in 1969 in Pennsylvania. For over five decades, we have provided our customers with products, services, and support. Innovation, continuous technological improvement and enhancement, and product quality are core values that are critical to our success. We are a significant supplier and innovator in the following areas: (i) software driven products and services used to create and monitor the physiological effects of flight, including high performance jet tactical flight simulation, fixed and rotary wing upset prevention and recovery and spatial disorientation, and both suborbital and orbital commercial human spaceflight, collectively, Aircrew Training Systems (“ATS”); (ii) altitude (hypobaric) chambers; (iii) hyperbaric chambers for multiple persons (multiplace chambers); (iv) Advanced Disaster Management Simulators (“ADMS”); (v) steam and gas (ethylene oxide) sterilizers; and (vi) environmental testing and simulation systems (“ETSS”).

We operate in two primary business segments, Aerospace Solutions (“Aerospace”) and Commercial/ Industrial Systems (“CIS”). Aerospace encompasses the design, manufacture, and sale of: (i) ATS products; (ii) altitude (hypobaric) chambers; (iii) hyperbaric chambers for multiple persons (multiplace chambers); and (iv) ADMS, as well as integrated logistics support (“ILS”) for customers who purchase these products or similar products manufactured by other parties. These products and services provide customers with an offering of comprehensive solutions for improved readiness and reduced operational costs. Sales of our Aerospace products are made principally to U.S. and foreign government agencies and to civil aviation organizations. CIS encompasses the design, manufacture, and sale of: (i) steam and gas (ethylene oxide) sterilizers; and (ii) ETSS; as well as parts and service support for customers who purchase these products or similar products manufactured by other parties. We sell our sterilizers to medical device manufacturers, pharmaceutical manufacturers, and universities. We sell ETSS primarily to commercial automotive and heating, ventilation, and air conditioning (“HVAC”) manufacturers.

ETC-PZL Aerospace Industries Sp. z o.o. (“ETC-PZL”), our 95%-owned subsidiary in Warsaw, Poland, is currently our only operating subsidiary. ETC-PZL manufactures certain simulators and provides software to support products manufactured domestically within our Aerospace segment.

The majority of our net sales are generated from long-term contracts with U.S. and foreign government agencies (including foreign military sales (“FMS”) contracted through the U.S. Government) for the research, design, development, manufacture, integration, and sustainment of ATS products, including altitude (hypobaric) and multiplace chambers (“Chambers”), and the simulators manufactured and sold through ETC-PZL, collectively, Aeromedical Training Solutions. The Company also enters into long-term contracts with domestic customers for the sale of sterilizers and ETSS. Net sales of ADMS are generally much shorter term in nature and vary between domestic and international customers. We generally provide our products and services under fixed-price contracts.

ETC’s unique ability to offer complete systems, designed and produced to high technical standards, sets it apart from its competition. ETC is headquartered in Southampton, PA. For more information about ETC, visit http://www.etcusa.com/.

Financial Tables Follow

Forward-looking Statements

This news release contains forward-looking statements, which are based on management's expectations and are subject to uncertainties and changes in circumstances. Words and expressions reflecting something other than historical fact are intended to identify forward-looking statements, and these statements may include terminology such as "may", "will", "should", "expect", "plan", "anticipate", "believe", "estimate", "future", "predict", "potential", "intend", or "continue", and similar expressions. We base our forward-looking statements on our current expectations and projections about future events or future financial performance. Our forward-looking statements are subject to known and unknown risks, uncertainties and assumptions about ETC and its subsidiaries that may cause actual results to be materially different from any future results implied by these forward-looking statements. We caution you not to place undue reliance on these forward-looking statements.