ETC Announces Fiscal 2021 Third Quarter Results

SOUTHAMPTON, PA, USA, January 28, 2021 – Environmental Tectonics Corporation (OTC Pink: ETCC) (“ETC” or the “Company”) today reported its financial results for the thirteen week period ended November 27, 2020 (the “2021 third quarter”) and the thirty-nine week period ended November 27, 2020 (the “2021 first three quarters”).

Robert L. Laurent, Jr., ETC’s Chief Executive Officer and President stated, “We were forced to implement temporary cost reductions in the 2021 third quarter to help stem the tide of the economic impact caused by the lock downs in reaction to the COVID-19 global pandemic. We hope that these temporary cost reductions can be lifted as we enter into what hopefully is a brighter fiscal 2022.”

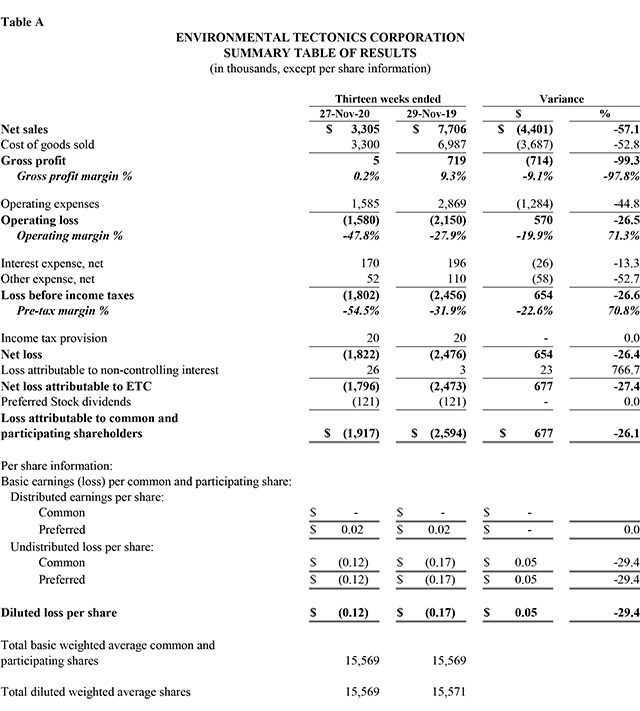

Fiscal 2021 Third Quarter Results of Operations

Net Loss Attributable to ETC

Net loss attributable to ETC was $1.8 million, or $0.12 diluted loss per share, in the 2021 third quarter, compared to $2.5 million during the 2020 third quarter, equating to $0.17 diluted loss per share. The $0.7 million improvement is due to the combined effect of a $1.3 million decrease in operating expenses and a $58 thousand decrease in other expense, net, offset, in part, by a $0.7 million decrease in gross profit.

Net Sales

Net sales in the 2021 third quarter were $3.3 million, a decrease of $4.4 million, or 57.1%, compared to 2020 third quarter net sales of $7.7 million. The decrease reflects lower International sales, especially within Aeromedical Training Solutions, lower Domestic sales, especially within the Environmental business unit, and lower monoplace chambers sales as a result of the asset sale on November 27, 2019.

Gross Profit

Gross profit for the 2021 third quarter was $5 thousand compared to $719 thousand in the 2020 third quarter, a decrease of $0.7 million, or 99.3%. The decrease in gross profit was due to lower net sales not being able to support fixed overhead expenses. Lower net sales were generated due to the combination of a lower backlog entering fiscal 2021 compounded with the effects of the COVID-19 global pandemic, which greatly impacted the Company’s ability to generate bookings, especially internationally. Gross profit margin as a percentage of net sales decreased to 0.2% for the 2021 third quarter compared to 9.3% for the 2020 third quarter.

Operating Expenses

Operating expenses, including sales and marketing, general and administrative, and research and development, for the 2021 third quarter were $1.6 million, a decrease of $1.3 million, or 44.8%, compared to $2.9 million for the 2020 third quarter. The decrease in operating expenses occurred across all three classifications due to the combined effect of a reduction in both headcount and the temporary implementation of a four-day work week for most employees as a result of a lack of work stemming from lock downs in reaction to the COVID-19 global pandemic. The reduction in selling and marketing expenses was further enhanced by a decrease in commission expense based on a lower concentration of International sales related to ATS products and a decrease in travel caused by the COVID-19 global pandemic.

Other Expense, Net

Other expense, net for the 2021 third quarter was $52 thousand compared to $110 thousand for the 2020 third quarter, a decrease of $58 thousand due primarily to lower letter of credit fees and realized exchange gains on foreign currency.

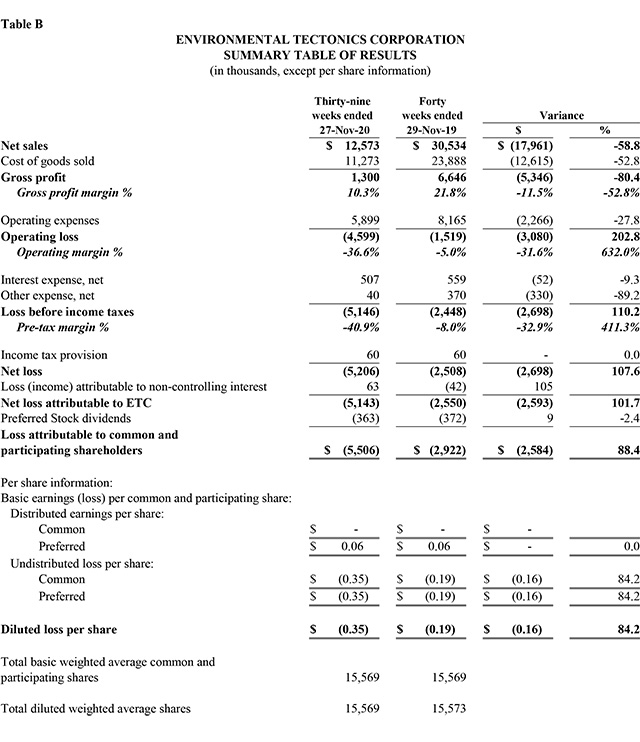

Fiscal 2021 First Three Quarters Results of Operations

Net Loss Attributable to ETC

Net loss attributable to ETC was $5.1 million, or $0.35 diluted loss per share, in the 2021 first three quarters, compared to $2.5 million during the 2020 first three quarters, equating to $0.19 diluted loss per share. The $2.6 million variance is due to the combined effect of a $5.3 million decrease in gross profit, offset, in part, by a $2.3 million decrease in operating expenses, a $0.3 million decrease in other expense, net, and a $52 thousand decrease in interest expense, net.

Net Sales

Net sales in the 2021 first three quarters were $12.6 million, a decrease of $17.9 million, or 58.8%, compared to 2020 first three quarters net sales of $30.5 million. The decrease reflects lower International sales, especially within Aeromedical Training Solutions, lower Domestic sales, especially within Simulation, lower overall Sterilizers and ETSS sales, and lower monoplace chambers sales as a result of the asset sale on November 27, 2019, offset, in part, by an increase in U.S. Government sales within Aeromedical Training Solutions in conjunction with the U.S. Air Force’s final acceptance of the RAC Contract.

Gross Profit

Gross profit for the 2021 first three quarters was $1.3 million compared to $6.6 million in the 2020 first three quarters, a decrease of $5.3 million, or 80.4%. The decrease in gross profit was due to lower net sales not being able to support fixed overhead expenses. Lower net sales were generated due to the combination of a lower backlog entering fiscal 2021 compounded with the effects of the COVID-19 global pandemic, which not only impacted the Company’s ability to generate bookings, especially internationally, but also forced the closure of our corporate headquarters and main production plant for about one-third of the 2021 first quarter in accordance with Pennsylvania state mandates. Gross profit margin as a percentage of net sales decreased to 10.3% for the 2021 first three quarters compared to 21.8% for the 2020 first three quarters.

Operating Expenses

Operating expenses, including sales and marketing, general and administrative, and research and development, for the 2021 first three quarters were $5.9 million, a decrease of $2.3 million, or 27.8%, compared to $8.2 million for the 2020 first three quarters. The decrease in operating expenses was due primarily to lower selling and marketing expenses, which included a decrease in commission expense based on a lower concentration of International sales related to ATS products, a reduction in headcount, and a decrease in travel caused by the COVID-19 global pandemic.

Interest Expense, Net

Interest expense, net for the 2021 first three quarters was $507 thousand compared to $559 thousand for the 2020 first three quarters, a decrease of $52 thousand due primarily to lower interest rates.

Other Expense, Net

Other expense, net for the 2021 first three quarters was $40 thousand compared to $370 thousand for the 2020 first three quarters, a decrease of $0.3 million due primarily to lower letter of credit fees and realized exchange gains on foreign currency.

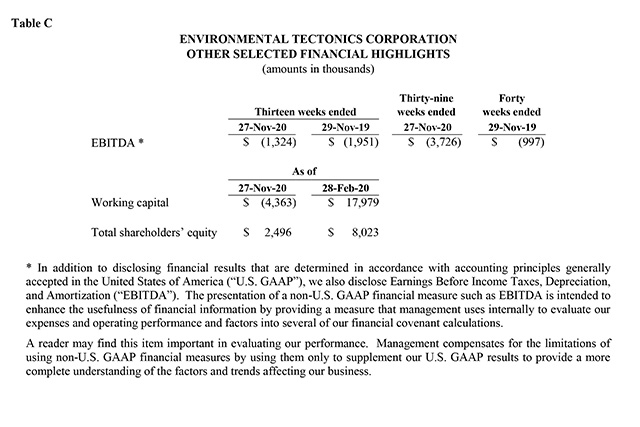

Cash Flows from Operating, Investing, and Financing Activities

During the 2021 first three quarters, due primarily from the net loss incurred and the decrease in accounts payable, offset, mostly by the decrease in accounts receivable and contract assets, the Company used $0.5 million of cash for operating activities compared to $10.5 million during the 2020 first three quarters. Under Accounting Standards Codification (“ASC”) 606, these accounts represent the timing differences of spending on production activities versus the billing and collecting of customer payments.

Cash used for investing activities primarily relates to funds used for capital expenditures of equipment and software development. The Company’s investing activities used $0.1 million during the 2021 first three quarters compared to $0.2 million during the 2020 first three quarters.

The Company’s financing activities provided $20 thousand of cash during the 2021 first three quarters with proceeds from the Payroll Protection Program loan mostly offsetting repayments under the Company’s credit facility compared to $7.0 million during the 2020 first three quarters exclusively from borrowings under the Company’s credit facility.

Financial Tables Follow

Forward-looking Statements

This news release contains forward-looking statements, which are based on management's expectations and are subject to uncertainties and changes in circumstances. Words and expressions reflecting something other than historical fact are intended to identify forward-looking statements, and these statements may include terminology such as "may", "will", "should", "expect", "plan", "anticipate", "believe", "estimate", "future", "predict", "potential", "intend", or "continue", and similar expressions. We base our forward-looking statements on our current expectations and projections about future events or future financial performance. Our forward-looking statements are subject to known and unknown risks, uncertainties and assumptions about ETC and its subsidiaries that may cause actual results to be materially different from any future results implied by these forward-looking statements. We caution you not to place undue reliance on these forward-looking statements.