ETC Announces Fiscal 2016 Full Year and Fourth Quarter Results and Notice of Annual Meeting of Shareholders

SOUTHAMPTON, PA, USA, June 14, 2016 – Environmental Tectonics Corporation (OTC Pink: ETCC) (“ETC” or the “Company”) today reported its financial results for the fifty-two week period ended February 26, 2016 (“fiscal 2016”) and the thirteen week period ended February 26, 2016 (the “2016 fourth quarter”) and also announced that the Company’s Annual Meeting of Shareholders (the “Annual Meeting”) will be held at The Fuge located at 780 Falcon Circle, Warminster, PA, 18974, USA on Wednesday, July 13, 2016, at 10:00 a.m.

Robert L. Laurent, Jr., ETC’s Chief Executive Officer and President stated, “We are pleased with the improving trends in our operating results and are excited about the prospects entering fiscal 2017.”

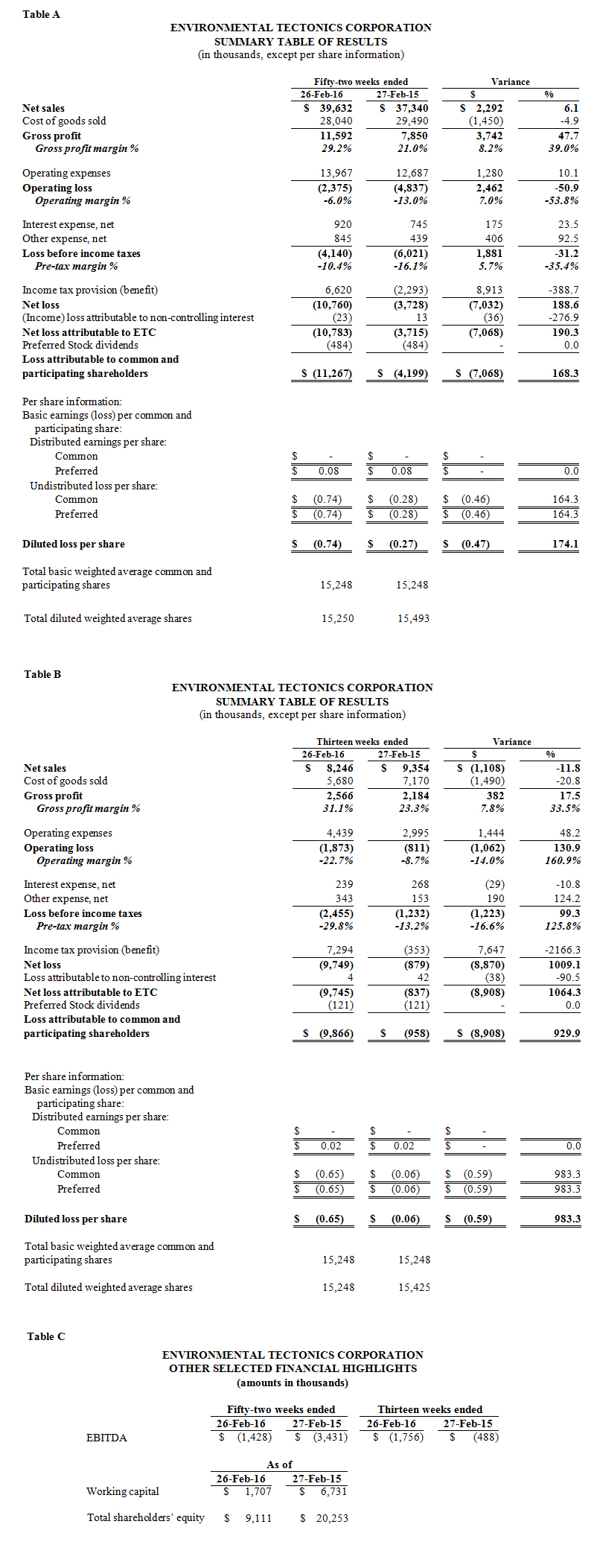

Fiscal 2016 Results of Operations

Net Loss Attributable to ETC

Net loss attributable to ETC was $10.8 million, or $0.74 diluted loss per share, in fiscal 2016, compared to a net loss attributable to ETC of $3.7 million during fiscal 2015, equating to $0.27 diluted loss per share. The $7.1 million variance reflects a decrease in loss before income taxes of $1.8 million due to the combined effect of a $3.7 million increase in gross profit, offset in part, by a $1.3 million increase in operating expenses, a $0.4 million increase in other expense, and a $0.2 million increase in interest expense. The $1.8 million decrease in loss before income taxes was offset by a $8.9 million variance between the $6.6 million income tax provision recorded in fiscal 2016 compared to the $2.3 million income tax benefit recorded in fiscal 2015. The $8.9 million variance related to income taxes is almost entirely due to the establishment of an $8.2 million valuation allowance for such deferred tax assets that we do not expect to realize primarily due to uncertainties related to our ability to utilize them before they expire. If there is a change in our ability to realize our deferred tax assets for which a valuation allowance has been established, then our tax valuation allowance may decrease in the period in which we determine that realization is more likely than not. As of February 26, 2016, the Company had approximately $20.3 million of federal net operating loss carryforwards available to offset future income tax liabilities, which will begin to expire in 2025.

Net Sales

Net sales for fiscal 2016 were $39.6 million, an increase of $2.3 million, or 6.1%, from fiscal 2015. The increase reflects increased sales related to ATS products including Chambers and ETC-PZL and other sales within our Aerospace segment to International customers, increased sales of our ADMS line of products to the U.S. Government, and overall increased sales of monoplace chambers, offset in part, by decreased sales of Sterilization Systems, Environmental Testing and Simulation Systems, and our ADMS line of products to Domestic customers and decreased sales related to ATS products including Chambers within our Aerospace segment to the U.S. Government. Given the current progress made on U.S. Government contracts in the Company’s backlog, coupled with a high concentration of International bookings during fiscal 2016, the Company anticipates that the concentration of sales to the U.S. Government will decrease in fiscal 2017 as International sales increase.

Gross Profit

Gross profit for fiscal 2016 was $11.6 million compared to $7.9 million in fiscal 2015, an increase of $3.7 million, or 47.7%. The significant increase in gross profit was a combination of both increased net sales and a higher gross profit margin percentage due primarily to the combination of a reduction in the amount of additional work required on several contracts and a higher concentration of net sales from more off-the-shelf type products requiring less initial design and engineering work. Gross profit margin as a percentage of net sales increased to 29.2% in fiscal 2016 compared to 21.0% in fiscal 2015.

Operating Expenses

Operating expenses, including sales and marketing, general and administrative, and research and development, for fiscal 2016 were $14.0 million, an increase of $1.3 million, or 10.1%, compared to $12.7 million for fiscal 2015. This increase is the combined result of an increase in commissions expense as the concentration of net sales shifts away from U.S. Government, an increase in International bid and proposal costs, a one-time severance charge, the write-off of a receivable deemed to be uncollectable, and increased research and development expenses related primarily to on-going research projects within the Simulation (ADMS), Hyperbaric, and Sterilizers business units, offset in part, by an on-going effort to reduce non-revenue generating expenses including a reduction in headcount, travel and entertainment, and tradeshow and advertising related expenses, as well as a reduction in legal expenses.

Interest Expense, Net

Interest expense, net, for fiscal 2016 was $0.9 million compared to $0.7 million in fiscal 2015, an increase of $0.2 million, or 23.5%, due to the combination of a higher level of bank borrowing throughout fiscal 2016 as a whole compared to fiscal 2015 and an increased interest rate.

Other Expense, Net

Other expense, net, for fiscal 2016 was $0.8 million compared to $0.4 million in fiscal 2015, an increase of $0.4 million, or 92.5%, due to an increase in letter of credit fees associated with the increase in International sales and an increase in realized foreign currency exchange net losses.

Income Taxes

As of February 26, 2016, the Company reviewed the components of its deferred tax assets and determined, based upon all available information, that it is more likely than not that deferred tax assets relating to its net operating loss carryforwards will not be realized primarily due to uncertainties related to our ability to utilize them before they expire. Accordingly, we have established an $8.2 million valuation allowance for such deferred tax assets that we do not expect to realize. If there is a change in our ability to realize our deferred tax assets for which a valuation allowance has been established, then our tax valuation allowance may decrease in the period in which we determine that realization is more likely than not.

An income tax provision of $6.6 million was recorded in fiscal 2016 compared to an income tax benefit of $2.3 million recorded in fiscal 2015. Effective tax rates were 159.9% and 38.1% for fiscal 2016 and fiscal 2015, respectively. Our effective fiscal 2016 tax rate was significantly higher than fiscal 2015 primarily due to the $7.6 million increase in the aforementioned valuation allowance.

Fiscal 2016 Fourth Quarter Results of Operations

Net Loss Attributable to ETC

Net loss attributable to ETC was $9.7 million, or $0.65 diluted loss per share, in the 2016 fourth quarter, compared to a $0.8 million net loss attributable to ETC during the 2015 fourth quarter, or $0.06 diluted loss per share. The $8.9 million variance reflects a decrease in loss before income taxes of $1.2 million due to a $1.4 million increase in operating expenses and a $0.2 million increase in other expenses, offset in part, by a $0.4 million increase in gross profit. The $1.2 million decrease in loss before income taxes was offset by a $7.6 million variance between the $7.3 million income tax provision recorded in fiscal 2016 compared to the $0.3 million income tax benefit recorded in fiscal 2015.

Net Sales

Net sales for the 2016 fourth quarter were $8.3 million, a decrease of $1.1 million, or 11.8%, compared to net sales of $9.4 million for the 2015 fourth quarter. The reduction reflects decreased sales related to ATS products including Chambers to the U.S. Government, offset in part, by increased sales related to ATS products including Chambers to International customers. Given the current progress made on U.S. Government contracts in the Company’s backlog, coupled with a high concentration of International bookings during fiscal 2016, the Company anticipates that the concentration of sales to the U.S. Government will decrease in fiscal 2017 as International sales increase.

Gross Profit

Gross profit for the 2016 fourth quarter increased by $0.4 million, or 17.5%, compared to the 2015 fourth quarter despite a $1.1 million decrease in net sales. The higher gross profit margin percentage was due primarily to the combination of a reduction in the amount of additional work required on several contracts and a higher concentration of net sales from more off-the-shelf type products requiring less initial design and engineering work. Gross profit margin as a percentage of net sales increased to 31.1% in the 2016 fourth quarter compared to 23.3% in the 2015 fourth quarter.

Operating Expenses

Operating expenses, including sales and marketing, general and administrative, and research and development, for the 2016 fourth quarter were $4.4 million, an increase of $1.4 million, or 48.2%, compared to $3.0 million for the 2015 fourth quarter. This increase is the combined result of an increase in commissions expense as the concentration of net sales shifts away from U.S. Government, an increase in International bid and proposal costs, a one-time severance charge, the write-off of a receivable deemed to be uncollectable, and increased research and development expenses related primarily to on-going research projects within the Simulation (ADMS), Hyperbaric, and Sterilizers business units, offset in part, by an on-going effort to reduce non-revenue generating expenses including a reduction in headcount, travel and entertainment, and tradeshow and advertising related expenses, as well as a reduction in legal expenses.

Interest Expense, Net

Interest expense, net, for the 2016 fourth quarter was $239 thousand compared to $268 thousand in the 2015 fourth quarter, a decrease of $29 thousand, or 10.8%, due primarily to the expiration on October 31, 2015 of the Export Import Loan Agreement through PNC Bank.

Other Expense, Net

Other expense, net, for the 2016 fourth quarter was $0.4 million compared to $0.2 million in the 2015 fourth quarter, an increase of $0.2 million, or 124.2%, due to an increase in letter of credit fees associated with the increase in International sales and an increase in realized foreign currency exchange net losses.

Income Taxes

An income tax provision of $7.3 million was recorded in the 2016 fourth quarter compared to an income tax benefit of $0.3 million recorded in the 2015 fourth quarter; a $7.6 million variance due almost entirely to the aforementioned valuation allowance and the primary reason for the significant increase in the effective tax rate of 297.1% for the 2016 fourth quarter compared to 28.7% for the 2015 fourth quarter.

Liquidity and Capital Resources

On June 10, 2016, the Company received a waiver as of the fiscal quarter ended February 26, 2016 for failing to exceed the permitted minimum Consolidated Tangible Net Worth. The waiver also provides that ETC must maintain at all times a minimum Consolidated Tangible Net Worth of $7.5 million; further, commencing with the fiscal quarter ending May 26, 2017, ETC must maintain as of the end of each fiscal quarter a Fixed Charge Coverage Ratio of at least 1.00 to 1. This ratio will increase to 1.10 to 1 on August 25, 2017, and will remain at that level at all times thereafter. The waiver also extends the maturity date of the existing PNC Line of Credit to August 10, 2016, during which time the Company expects to enter into a new loan agreement with PNC Bank that is expected to provide for, among other things, terms similar or slightly more favorable than the existing terms provided under the September 28, 2012 Loan Agreement with PNC Bank through December 31, 2017.

As of February 26, 2016, the Company’s availability under the PNC Line of Credit was $1.4 million. This reflected cash borrowings of $11.6 million and net outstanding standby letters of credit not covered by the Committed Line of Credit of approximately $0.5 million. As of June 1, 2016, the date of our most current PNC Line of Credit statement, the Company’s availability under the PNC Line of Credit was approximately $10.5 million. Working capital was $1.7 million and $6.7 million as of February 26, 2016 and February 27, 2015, respectively. The decrease in working capital was primarily the result of a decrease in costs and estimated earnings in excess of billings on uncompleted long-term contracts and an increase in billings in excess of costs and estimated earning on uncompleted long-term contracts. Under percentage-of-completion (“POC”) revenue recognition, these accounts represent the timing differences of spending on production activities versus the billing of customer payments.

Cash flows from operating activities

During fiscal 2016, despite the significant net loss, and due primarily from the increase in billings in excess of costs and estimated earnings on uncompleted long-term contracts and a decrease in both costs and estimated earnings in excess of billings on uncompleted long-term contracts and accounts receivable, the Company generated $6.5 million of cash from operating activities compared to $0.5 million of cash used in operating activities in fiscal 2015.

Cash flows from investing activities

Cash used for investing activities primarily relates to funds used for capital expenditures in property, plant, and equipment and software development. The Company’s fiscal 2016 investing activities used $1.2 million, which consisted primarily of equipment and software enhancements for our Authentic Tactical Fighting System (“ATFS”) and ADMS technologies and Upset Prevention and Recovery Training (“UPRT”) capabilities, and costs to upgrade existing information technology systems. This is a decrease of $0.3 million from cash used in investing activities in fiscal 2015.

Cash flows from financing activities

During fiscal 2016, the Company’s financing activities used $4.8 million of cash, which primarily reflected a $3.6 million increase in restricted cash and $1.2 million increase in borrowings under the PNC Line of Credit. During fiscal 2015, a $2.4 million reduction in restricted cash and $0.9 million of repayments under the Company’s various lines of credit, offset in part, by $1.7 million in Term Loan payments, generated $1.6 million of cash.

Notice of Annual Meeting of Shareholders

The Annual Meeting will be held at The Fuge located at 780 Falcon Circle, Warminster, PA, 18974, USA on Wednesday, July 13, 2016, at 10:00 a.m. for the following purposes:

- To elect seven (7) Directors to serve on the Board of Directors until ETC’s 2017 Annual Meeting of Shareholders and until their successors are elected.

- To ratify the appointment of RSM US LLP as the independent registered public accounting firm for ETC for the fiscal year ending February 24, 2017.

- To transact such other business as may properly come before the meeting and any adjournment of the meeting.

The Board of Directors has fixed the close of business on May 27, 2016 as the record date for the determination of shareholders entitled to notice of and to vote at the Annual Meeting.

To vote your shares at the Annual Meeting, you or your designated proxy must be present at the Annual Meeting.

A copy of the Company’s 2016 Annual Report is available within the Investors section of ETC’s website at https://www.etcusa.com/investors/shareholder-information/annual-meetingshareholders-materials/.

– Financial Tables Follow –

Forward-looking Statements

This news release contains forward-looking statements, which are based on management's expectations and are subject to uncertainties and changes in circumstances. Words and expressions reflecting something other than historical fact are intended to identify forward-looking statements, and these statements may include terminology such as "may", "will", "should", "expect", "plan", "anticipate", "believe", "estimate", "future", "predict", "potential", "intend", or "continue", and similar expressions. We base our forward-looking statements on our current expectations and projections about future events or future financial performance. Our forward-looking statements are subject to known and unknown risks, uncertainties and assumptions about ETC and its subsidiaries that may cause actual results to be materially different from any future results implied by these forward-looking statements. We caution you not to place undue reliance on these forward-looking statements.