ETC Announces Fiscal 2014 Full Year and Fourth Quarter Results

SOUTHAMPTON, PA, USA, June 3, 2014 – Environmental Tectonics Corporation (OTC Pink: ETCC) (“ETC” or the “Company”) today reported its financial results for fiscal 2014 and its fiscal 2014 fourth quarter ended February 28, 2014.

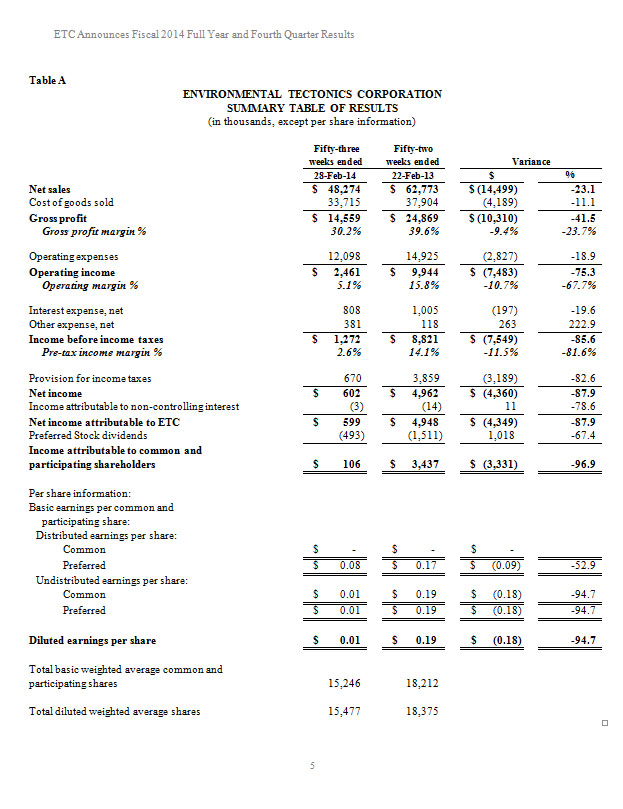

Fiscal 2014 Results of Operations

Net Income Attributable to ETC

Net income attributable to ETC was $0.6 million, or $0.01 per diluted share, in fiscal 2014 versus $4.9 million, or $0.19 per diluted share, in fiscal 2013; a decrease of $4.3 million, or 87.9%. The decrease in net income attributable to ETC reflects a decrease in income before income taxes of $7.5 million, or 85.6%, due primarily to a $10.3 million decrease in gross profit, resulting from a combination of both lower net sales and lower gross profit margin percentage, offset by a $2.8 million decrease in operating expenses, resulting primarily from an on-going effort to reduce non-revenue generating expenses.

Net Sales

Net sales for fiscal 2014 were $48.3 million, a decrease of $14.5 million, or 23.1%, from fiscal 2013. The reduction reflects decreased sales within our Aerospace segment to the U.S. Government and decreased sales of sterilizers and environmental testing and simulation devices to Domestic customers, offset in part, by increased sales within our Aerospace segment to International customers. Given the current progress made on U.S. Government contracts in the Company’s sales backlog, the Company anticipates the concentration of sales to the U.S. Government will continue to lessen in fiscal 2015.

Gross Profit

Gross profit for fiscal 2014 decreased by $10.3 million, or 41.5%, compared to fiscal 2013. The significant decrease in gross profit was a combination of both lower net sales and lower gross profit margin percentage due to inefficiencies as a result of additional work required on several contracts, for which we are currently pursuing recovery. On April 24, 2014, we reached a favorable settlement agreement on the first of these recoveries that partially offset the effects of the additional work. Gross profit margin as a percentage of net sales decreased to 30.2% in fiscal 2014 compared to 39.6% in fiscal 2013.

Operating Expenses

Operating expenses, including sales and marketing, general and administrative, and research and development, for fiscal 2014 were $12.1 million, a decrease of $2.8 million, or 18.9%, compared to $14.9 million for fiscal 2013. This decrease is primarily the result of an on-going effort to reduce non-revenue generating expenses, as well as lower commissions due to lower net sales, offset in part, by an increase in research and development expenses due to less grant payments received to offset expenses in fiscal 2014.

Interest Expense, Net

Interest expense, net for fiscal 2014 was $0.8 million compared to $1.0 million in fiscal 2013, a decrease of $0.2 million, or 19.6%, despite a higher level of bank borrowing due primarily to the results of the 2012 Financial Restructuring.

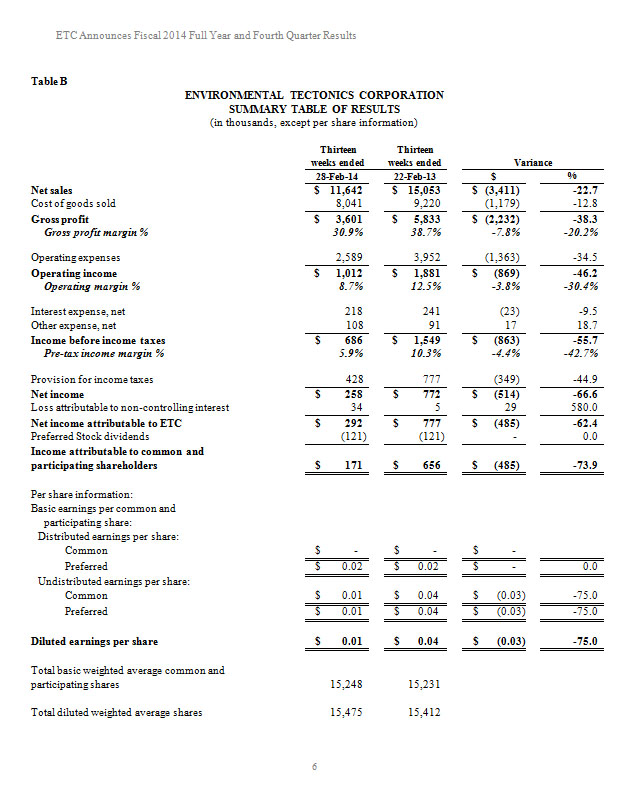

Fiscal 2014 Fourth Quarter Results of Operations

Net Income Attributable to ETC

Net income attributable to ETC was $0.3 million, or $0.01 per diluted share, in the fiscal 2014 fourth quarter versus $0.8 million, or $0.04 per diluted share, in the fiscal 2013 fourth quarter; a decrease of $0.5 million, or 62.4%. The decrease in net income attributable to ETC reflects a decrease in income before income taxes of $0.9 million, or 55.7%, due primarily to a $2.2 million decrease in gross profit, resulting from a combination of both lower net sales and lower gross profit margin percentage, offset by a $1.4 million decrease in operating expenses, resulting primarily from an on-going effort to reduce non-revenue generating expenses.

Net Sales

Net sales for the fiscal 2014 fourth quarter were $11.6 million, a decrease of $15.1 million, or 22.7%, compared to the fiscal 2013 fourth quarter. The reduction primarily reflects decreased sales within our Aerospace segment to the U.S. Government. Given the current progress made on U.S. Government contracts in the Company’s sales backlog, the Company anticipates the concentration of sales to the U.S. Government will continue to lessen in fiscal 2015.

Gross Profit

Gross profit for the fiscal 2014 fourth quarter decreased by $2.2 million, or 38.3%, compared to the fiscal 2013 fourth quarter. The significant decrease in gross profit was a combination of both lower net sales and lower gross profit margin percentage due to inefficiencies as a result of additional work required on several contracts, for which we are currently pursuing recovery. On April 24, 2014, we reached a favorable settlement agreement on the first of these recoveries that partially offset the effects of the additional work. Gross profit margin as a percentage of net sales decreased to 30.9% for the fiscal 2014 fourth quarter compared to 38.7% for the fiscal 2013 fourth quarter.

Operating Expenses

Operating expenses, including sales and marketing, general and administrative, and research and development, for the fiscal 2014 fourth quarter were $2.6 million, a decrease of $1.4 million, or 34.5%, compared to $4.0 million for the fiscal 2013 fourth quarter. This decrease is primarily the result of an on-going effort to reduce non-revenue generating expenses, as well as lower commissions due to lower net sales, offset in part, by an increase in research and development expenses due to less grant payments received to offset expenses in the fiscal 2014 fourth quarter.

Interest Expense, Net

Interest expense, net for both the fiscal 2014 fourth quarter and the fiscal 2013 fourth quarter was $0.2 million due to the results of the 2012 Financial Restructuring having an equivalent effect on both quarters.

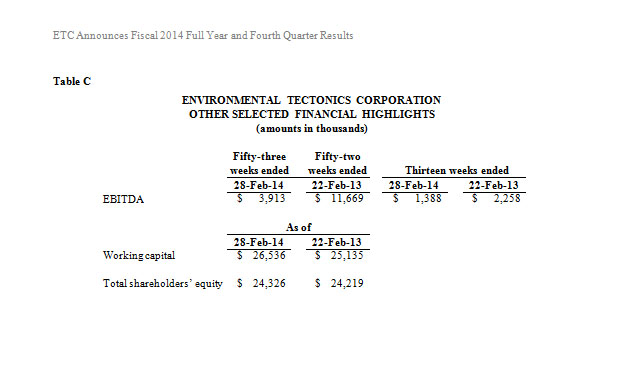

Cash Flows from Operating, Investing, and Financing Activities

During fiscal 2014, as a result of an increase in costs and estimated earnings in excess of billings on uncompleted long-term percentage-of-completion (“POC”) contracts and decreases in accounts payable, customer deposits, and other accrued liabilities, the Company used $0.6 million of cash in operating activities compared to $7.3 million of cash provided by operating activities in fiscal 2013.

Cash used for investing activities primarily relates to funds used for capital expenditures in property, plant, and equipment and software development. The Company’s fiscal 2014 investing activities used $1.4 million, which consisted primarily of equipment and software enhancements for our ATFS technology, and costs to upgrade CIS demonstration equipment and existing information technology systems. This is an increase of $0.1 million from cash used in investing activities in fiscal 2013.

The Company’s financing activities generated $0.1 million during fiscal 2014 as compared to using $6.4 million in fiscal 2013. The principal uses of cash were $4.4 million of payments on the Term Loan and $0.4 million in Preferred Stock dividends. These were offset by $3.7 million in borrowings under the Company’s various lines of credit and a $1.2 million reduction in restricted cash.

Board of Directors Actions

On May 28, 2014, the Company’s Board of Directors (the “Board of Directors”) unanimously approved a resolution to amend and restate the Company’s bylaws to, among other things, amend certain governance provisions to reflect recent changes at the Company (e.g., bifurcation of the roles of Chief Executive Officer and President and no longer being an SEC reporting company), to update the bylaws under the Pennsylvania Business Corporation Law, and to make certain other conforming and technical changes. Some of these amendments relate to the composition of the Board of Directors and its committees, advance notice provisions for shareholder meetings, indemnification, and action by written consent. The Board of Directors also approved an amendment to Section 8(b) of the Statement With Respect to Shares of the Series E Preferred Stock of the Company, clarifying the composition of the Board of Directors. These amendments were also approved by the written consent of the holder of all of the Series E Preferred Stock and holders of Common Stock. A copy of the amended and restated bylaws and the amendment to Section 8(b) are available to shareholders upon request.

Forward-looking Statements

This news release contains forward-looking statements, which are based on management's expectations and are subject to uncertainties and changes in circumstances. Words and expressions reflecting something other than historical fact are intended to identify forward-looking statements, and these statements may include terminology such as "may", "will", "should", "expect", "plan", "anticipate", "believe", "estimate", "future", "predict", "potential", "intend", or "continue", and similar expressions. We base our forward-looking statements on our current expectations and projections about future events or future financial performance. Our forward-looking statements are subject to known and unknown risks, uncertainties and assumptions about ETC and its subsidiaries that may cause actual results to be materially different from any future results implied by these forward-looking statements. We caution you not to place undue reliance on these forward-looking statements.