ETC Announces Fiscal 2013 Second Quarter Results

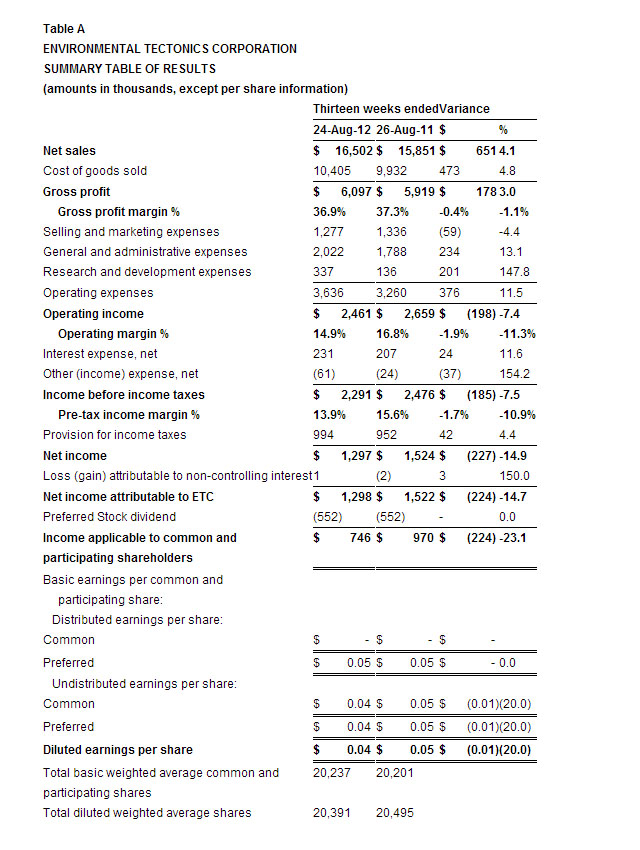

Fiscal 2013 Second Quarter Results:

- Net sales increased 4.1% to $16.5 million

- Diluted earnings per share of $0.04

- Net cash from operating activities of $4.9 million

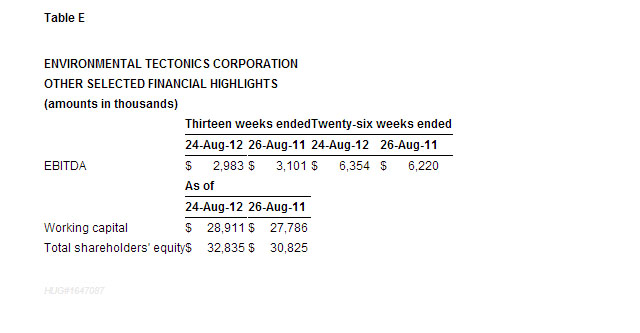

- Fiscal 2013 first half EBITDA increased 2.2% to $6.4 million

SOUTHAMPTON, PA, USA, October 9, 2012 – Environmental Tectonics Corporation (OTCQB: ETCC) (“ETC” or the “Company”) today reported net sales for the fiscal 2013 second quarter (“the 2013 second quarter”) of $16.5 million, an increase of $0.6 million, or 4.1% compared to net sales of $15.9 million in the fiscal 2012 second quarter (“the 2012 second quarter”). The increase reflects increased sales to Domestic customers, offset in part, by decreased sales to the U.S. Government.

As a result of a slight decrease in gross profit margin as a percentage of net sales and an increase in operating expenses, income before income taxes for the 2013 second quarter decreased slightly to $2.3 million, a 7.5% decrease compared to the 2012 second quarter. Net income attributable to ETC for both the 2013 second quarter and the 2012 second quarter was affected by income tax provisions of $1.0 million; as a result, net income attributable to ETC for the 2013 second quarter was $1.3 million, or $0.04 per diluted share, compared to $1.5 million, or $0.05 per diluted share, in the 2012 second quarter, a decrease in net income attributable to ETC of $0.2 million, or 14.7%.

William F. Mitchell, ETC’s President and Chief Executive Officer, stated, “We are very pleased that for the fiscal 2013 first half ended August 24, 2012, ETC continued to have robust sales and increased earnings before interest, taxes, depreciation, and amortization.”

Business Overview:

ETC designs, manufactures, and sells software driven products and services used to recreate and monitor the physiological effects of motion on humans and equipment and to control, modify, simulate, and measure environmental conditions. We operate in two primary business segments, Aerospace Solutions (“Aerospace”) and Commercial/Industrial Systems (“CIS”). Aerospace encompasses the design, manufacture, and sale of (1) software driven products and services used to create and monitor the physiological effects of flight, including high performance jet tactical flight simulation, upset recovery and spatial disorientation, and both suborbital and orbital commercial human spaceflight; collectively, Aircrew Training Systems (“ATS”); (2) altitude (hypobaric) chambers; (3) hyperbaric (100% oxygen) chambers for multiple persons (multiplace chambers); and (4) the Advanced Disaster Management Simulator (“ADMS”), as well as integrated logistics support for customers who purchase these products. These products and services provide customers with an offering of comprehensive solutions for improved readiness and reduced operational costs. Sales of our Aerospace products are made principally to U.S. and foreign government agencies. CIS operations encompass the design, manufacture, and sale of core technologies including: (1) steam and gas (ethylene oxide) sterilizers; (2) environmental testing and simulation devices; (3) hyperbaric (100% oxygen) chambers for one person (monoplace chambers); and (4) parts and service support. Sales of our CIS products are made principally to the healthcare, pharmaceutical, and automotive industries.

We presently have two foreign operating subsidiaries. ETC-PZL Aerospace Industries SP. Z 0.0, (“ETC-PZL”), our 95%-owned subsidiary in Warsaw, Poland, manufactures simulators and provides software to support our domestic products. Environmental Tectonics Corporation (Europe) Limited (“ETC-Europe”), our 99%-owned subsidiary, functions as a sales office in the United Kingdom.

ETC’s unique ability to offer complete systems, designed and produced to high technical standards, sets it apart from its competition. ETC is headquartered in Southampton, PA. For more information about ETC, visit http://www.etcusa.com/.

Fiscal 2013 Second Quarter Results of Operations:

Domestic sales in the 2013 second quarter were $5.0 million, an increase of $2.2 million, or 81.0%, over 2012 second quarter sales of $2.8 million. The increase in Domestic sales is due primarily to an increase in Environmental, Sterilizer, and Hyperbaric sales within the CIS segment. Domestic sales represented 30.2% of the Company’s total net sales in the 2013 second quarter compared to 17.4% of the Company’s total net sales in the 2012 second quarter.

U.S. Government sales in the 2013 second quarter were $6.7 million, a decrease of $1.8 million, or 20.5%, compared to 2012 second quarter sales of $8.5 million, and represented 40.9% of total net sales in the 2013 second quarter compared to 53.5% for the 2012 second quarter. This decrease is the result of lower ATS sales, offset in part, by an increase in sales related to a suite of research altitude chambers. Given the existing progress made on U.S. Government sales contracts in the Company’s backlog, the Company anticipates the concentration of sales to the U.S. Government will continue to lessen in fiscal 2013.

International sales for the 2013 second quarter, including those of the Company’s foreign subsidiaries, were $4.8 million compared to $4.6 million in the 2012 second quarter, an increase of $0.2 million, or 3.5%, and represented 28.9% of total net sales in the 2013 second quarter compared to 29.1% in the 2012 second quarter. The increase in International sales reflects an increase in ATS sales, offset in part, by a decrease in Hyperbaric sales.

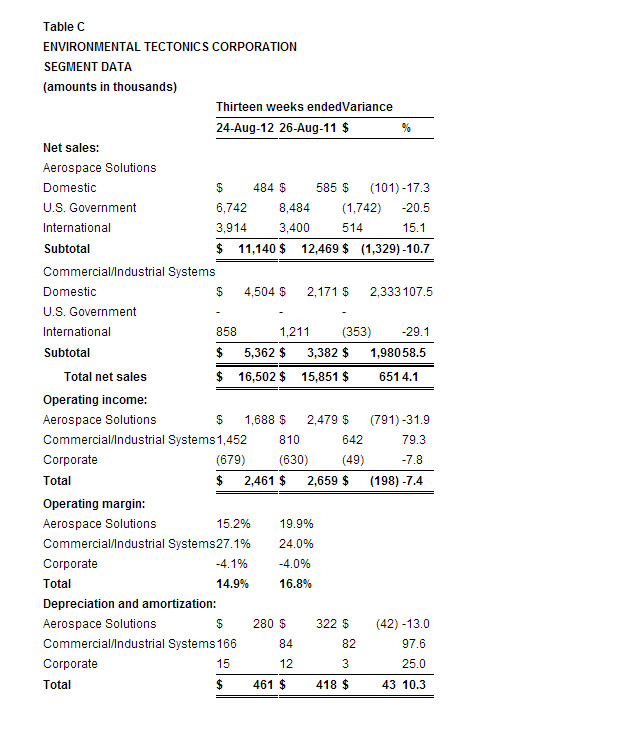

Segment sales

Aerospace sales were $11.1 million for the 2013 second quarter, a decrease of $1.4 million, or 10.7%, compared to sales of $12.5 million in the 2012 second quarter. Sales of these products accounted for 67.5% of our net sales for the 2013 second quarter compared to 78.7% in the 2012 second quarter. CIS sales increased $2.0 million, or 58.5%, to $5.4 million for the 2013 second quarter compared to $3.4 million in the 2012 second quarter, and constituted 32.5% of our net sales for the 2013 second quarter compared to 21.3% in the 2012 second quarter.

Gross profit

Gross profit for the 2013 second quarter was $6.1 million as compared to $5.9 million in the 2012 second quarter, an increase of $0.2 million, or 3.0%. The increase in gross profit was a result of an increase in net sales; however, gross profit margin as a percentage of net sales decreased slightly to 36.9% in the 2013 second quarter from 37.3% in the 2012 second quarter.

Operating expenses

Selling and marketing expenses for the 2013 second quarter of $1.3 million remained unchanged compared to the 2012 second quarter. As a percentage of net sales, selling and marketing expenses decreased to 7.7% in the 2013 second quarter from 8.4% in the 2012 second quarter. Although the dollar amount of selling and marketing expenses did not change, there was a decrease in commission generating revenue in the 2013 second quarter compared to the 2012 second quarter; thus, commission expense as a percentage of net sales was lower in the 2013 second quarter compared to the 2012 second quarter.

General and administrative expenses for the 2013 second quarter were $2.0 million, an increase of $0.2 million, or 13.1%, compared to $1.8 million for the 2012 second quarter. As a percentage of net sales, general and administrative expenses increased to 12.3% in the 2013 second quarter from 11.3% in the 2012 second quarter. The increase is primarily the result of an increase in domestic salary expenses and expenses related to ETC-PZL, offset in part, by a decrease in consulting expenses.

Research and development expenses include spending for potential new products and technologies, and internationally, work performed under government grant programs. This spending, net of grant payments from the Polish and Turkish governments, totaled $0.3 million for the 2013 second quarter compared to $0.1 million for the 2012 second quarter, an increase of $0.2 million. The increase was a result of less research and development employees being assigned to specific contracts; thus, expenses related to these employees were included in research and development expenses in the 2013 second quarter. Most of the Company’s research efforts, which were and continue to be a significant cost of its business, are included in cost of sales for applied research for specific contracts, as well as research for feasibility and technology updates. As a percentage of sales, research and development expenses were 2.0% in the 2013 second quarter compared to 0.9% in the 2012 second quarter.

Operating income

Operating income decreased by $0.2 million, or 7.4%, to $2.5 million for the 2013 second quarter compared to $2.7 million in the 2012 second quarter. Operating income as a percentage of net sales decreased to 14.9% from 16.8% in the 2012 second quarter. On a segment basis, Aerospace had operating income of $1.7 million for the 2013 second quarter, a $0.8 million decrease from operating income of $2.5 million in the 2012 second quarter. CIS had operating income of $1.5 million in the 2013 second quarter, a $0.7 million increase from operating income of $0.8 million in the 2012 second quarter. These segment operating results were offset, in part, by unallocated corporate expenses of $0.7 million and $0.6 million in the 2013 second quarter and the 2012 second quarter, respectively.

Interest expense, other income and expense, and taxes

Interest expense, net, for the 2013 second quarter was $231 thousand compared to $207 thousand in the 2012 second quarter, representing a higher level of bank borrowing as a result of cash used in operations through the better part of the 2013 second quarter, primarily for costs and estimated earnings in excess of billings on uncompleted long-term contracts.

Other income, net for the 2013 second quarter was $61 thousand compared to other income, net of $24 thousand in the 2012 second quarter, an increase of $37 thousand. Other (income) expense, net consists primarily of bank and letter of credit fees, as well as foreign currency exchange gains and losses.

As of August 24, 2012, the Company reviewed the components of its deferred tax assets and determined, based upon all available information, that its current and expected future operating income will more likely than not result in the realization of its deferred tax assets relating to its federal net operating loss carryforwards. The Company has a net deferred tax asset related primarily to its federal net operating loss carryforwards of $6.5 million. Income tax provisions of $1.0 million were recorded in both the 2013 second quarter and the 2012 second quarter.

As of August 24, 2012, the Company had approximately $18.4 million of federal net loss carryforwards available to offset future income tax liabilities, which begin to expire in 2025. In addition, the Company has the ability to offset deferred tax assets against deferred tax liabilities created for such items as depreciation and amortization.

Net income attributable to ETC

Net income attributable to ETC was $1.3 million, or $0.04 diluted earnings per share, in the 2013 second quarter, compared to $1.5 million or $0.05 diluted earnings per share, during the 2012 second quarter, representing a decrease of $224 thousand, or 14.7%. This decrease reflects a decrease in income before income taxes of $185 thousand, a result of a $178 thousand increase in gross profit, which was more than offset by a $376 thousand increase in operating expenses.

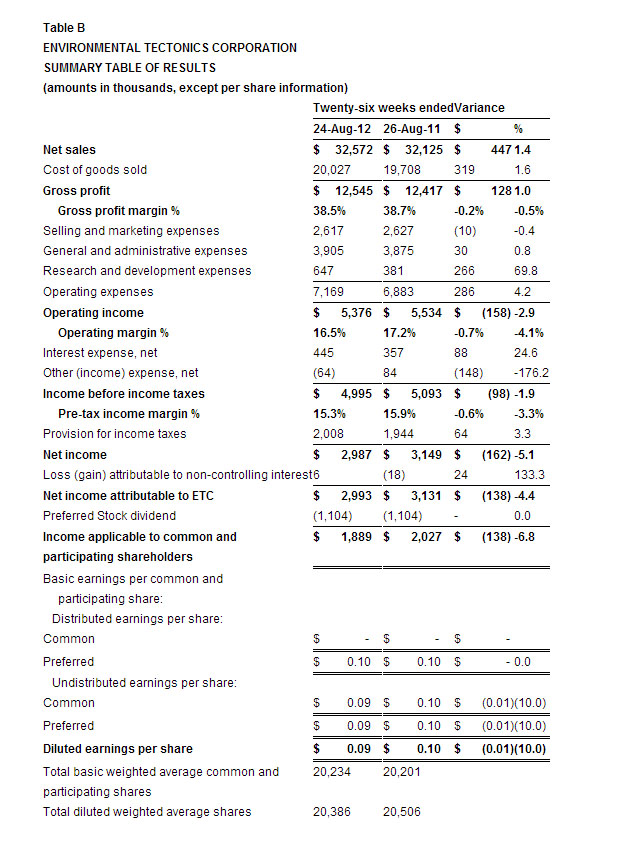

Fiscal 2013 First Half Results of Operations:

Domestic sales in the fiscal 2013 first half (“the 2013 first half”) were $10.5 million, an increase of $3.5 million, or 48.9%, over 2012 first half (“the 2012 first half”) sales of $7.0 million. The increase in Domestic sales is due primarily to an increase in Environmental and Sterilizer sales within the CIS segment, offset in part, by a decrease in Simulation sales. Domestic sales represented 32.1% of the Company’s total net sales in the 2013 first half compared to 21.9% of the Company’s total net sales in the 2012 first half.

U.S. Government sales in the 2013 first half were $13.1 million, a decrease of $3.0 million, or 18.5%, compared to 2012 first half sales of $16.1 million, and represented 40.3% of total net sales in the 2013 first half compared to 50.2% for the 2012 first half. This decrease is the result of lower ATS sales, offset in part, by an increase in sales related to a suite of research altitude chambers. Given the existing progress made on U.S. Government sales contracts in the Company’s backlog, the Company anticipates the concentration of sales to the U.S. Government will continue to lessen in fiscal 2013.

International sales for the 2013 first half, including those of the Company’s foreign subsidiaries, of $9.0 million remained unchanged compared to the 2012 first half, and represented 27.5% of total net sales in the 2013 first half compared to 27.9% in the 2012 first half. Although the dollar amount of International sales did not change, there was an increase in ATS and Environmental sales, offset in part, by a decrease in Hyperbaric sales.

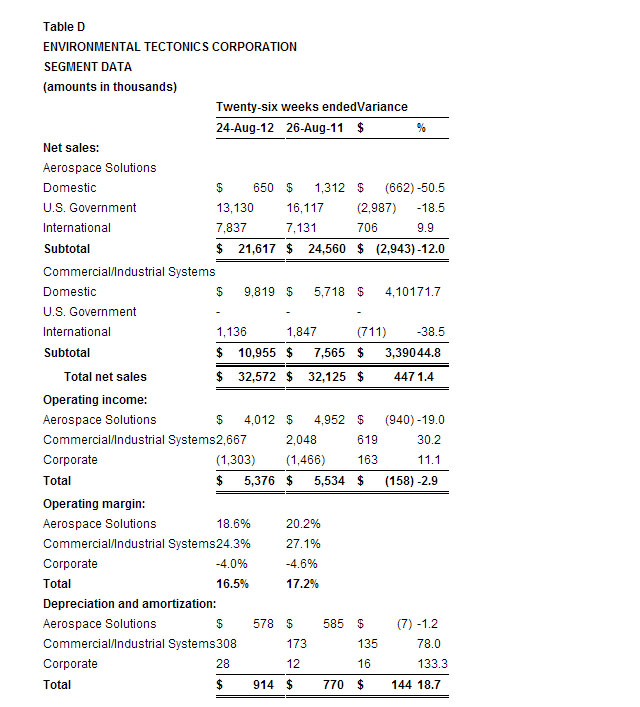

Segment sales

Aerospace sales were $21.6 million for the 2013 first half, a decrease of $3.0 million, or 12.0%, compared to sales of $24.6 million in the 2012 first half. Sales of these products accounted for 66.4% of our net sales for the 2013 first half compared to 76.5% in the 2012 first half. CIS sales increased $3.4 million, or 44.8%, to $11.0 million for the 2013 first half compared to $7.6 million in the 2012 first half, and constituted 33.6% of our net sales for the 2013 first half compared to 23.5% in the 2012 first half.

Gross profit

Gross profit for the 2013 first half was $12.5 million compared to $12.4 million in the 2012 first half, an increase of $0.1 million, or 1.0%. The increase in gross profit was a result of an increase in net sales; however, gross profit margin as a percentage of net sales decreased slightly to 38.5% in the 2013 first half from 38.7% in the 2012 first half.

Operating expenses

Selling and marketing expenses for the 2013 first half of $2.6 million remained unchanged compared to the 2012 first half. As a percentage of net sales, selling and marketing expenses decreased to 8.0% in the 2013 first half from 8.2% in the 2012 first half. Although the dollar amount of selling and marketing expenses did not change, there was a decrease in commission generating revenue in the 2013 first half compared to the 2012 first half; thus, commission expense as a percentage of net sales was lower in the 2013 first half compared to the 2012 first half.

General and administrative expenses for the 2013 first half of $3.9 million remained unchanged compared to the 2012 first half. As a percentage of net sales, general and administrative expenses decreased to 12.0% in the 2013 first half from 12.1% in the 2012 first half. Although the dollar amount of general and administrative expenses did not change, there was an increase in domestic salary expenses and expenses related to ETC-PZL and ETC-Europe, offset by a decrease in consulting expenses and the absence of a one-time charge to vacation expense in the 2012 first half.

Research and development expenses include spending for potential new products and technologies, and internationally, work performed under government grant programs. This spending, net of grant payments from the Polish and Turkish governments, totaled $0.6 million for the 2013 first half compared to $0.4 million for the 2012 first half, an increase of $0.2 million, or 69.8%. The increase was a result of less research and development employees being assigned to specific contracts; thus, expenses related to these employees were included in research and development expenses in the 2013 first half. Most of the Company’s research efforts, which were and continue to be a significant cost of its business, are included in cost of sales for applied research for specific contracts, as well as research for feasibility and technology updates. As a percentage of sales, research and development expenses were 2.0% in the 2013 first half compared to 1.2% in the 2012 first half.

Operating income

Operating income decreased by $0.1 million, or 2.9%, to $5.4 million for the 2013 first half compared to $5.5 million in the 2012 first half. Operating income as a percentage of net sales decreased to 16.5% from 17.2% in the 2012 first half. On a segment basis, Aerospace had operating income of $4.0 million for the 2013 first half, a $1.0 million decrease from operating income of $5.0 million in the 2012 first half. CIS had operating income of $2.7 million in the 2013 first half, a $0.7 million increase from operating income of $2.0 million in the 2012 first half. These segment operating results were offset, in part, by unallocated corporate expenses of $1.3 million and $1.5 million in the 2013 first half and the 2012 first half, respectively.

Interest expense, other income and expense, and taxes

Interest expense, net, for the 2013 first half was $445 thousand as compared to $357 thousand in the 2012 first half, representing a higher level of bank borrowing as a result of cash used in operations through the better part of the 2013 first half, primarily for costs and estimated earnings in excess of billings on uncompleted long-term contracts.

Other income, net for the 2013 first half was $64 thousand compared to other expense, net of $84 thousand in the 2012 first half, a difference of $148 thousand. Other (income) expense, net consists primarily of bank and letter of credit fees, as well as foreign currency exchange gains and losses.

As of August 24, 2012, the Company reviewed the components of its deferred tax assets and determined, based upon all available information, that its current and expected future operating income will more likely than not result in the realization of its deferred tax assets relating to its federal net operating loss carryforwards. The Company has a net deferred tax asset related primarily to its federal net operating loss carryforwards of $6.5 million. Income tax provisions of $2.0 million and $1.9 million were recorded in the 2013 first half and the 2012 first half, respectively.

As of August 24, 2012, the Company had approximately $18.4 million of federal net loss carryforwards available to offset future income tax liabilities, which begin to expire in 2025. In addition, the Company has the ability to offset deferred tax assets against deferred tax liabilities created for such items as depreciation and amortization.

Net income attributable to ETC

Net income attributable to ETC was $3.0 million, or $0.09 diluted earnings per share, in the 2013 first half, compared to $3.1 million or $0.10 diluted earnings per share, during the 2012 first half, representing a decrease of $138 thousand, or 4.4%. This decrease reflects a decrease in operating income of $158 thousand, a result of a $128 thousand increase in gross profit, which was more than offset by a $286 thousand increase in operating expenses.

Liquidity and capital resources

As a result of collections pertaining to several of our long-term contracts as they begin to wind down, the Company reduced the amount outstanding on its line of credit during the 2013 first half. The Company’s availability under its line of credit with PNC Bank at August 24, 2012 was $5.0 million. The Company expects the availability to continue increasing as several of our long-term contracts with back loaded cash receipts continue to wind down. Working capital, or current assets less current liabilities, was $28.9 million at August 24, 2012 compared with $27.8 million at February 24, 2012. The increase in working capital was primarily the result of an increase in costs and estimated earnings in excess of billings on uncompleted long-term contracts, which will reduce upon the achievement of certain milestones, as well as a decrease in billings in excess of costs and estimated earnings on uncompleted long-term contracts. The Company’s current ratio, current assets divided by current liabilities, improved to 2.6:1 at August 24, 2012 from 2.4:1 at February 24, 2012.

Financial Tables Follow

Forward-looking Statements

This news release contains forward-looking statements, which are based on management's expectations and are subject to uncertainties and changes in circumstances. Words and expressions reflecting something other than historical fact are intended to identify forward-looking statements, and these statements may include terminology such as "may", "will", "should", "expect", "plan", "anticipate", "believe", "estimate", "future", "predict", "potential", "intend", or "continue", and similar expressions. We base our forward-looking statements on our current expectations and projections about future events or future financial performance. Our forward-looking statements are subject to known and unknown risks, uncertainties and assumptions about ETC and its subsidiaries that may cause actual results to be materially different from any future results implied by these forward-looking statements. We caution you not to place undue reliance on these forward-looking statements.