ETC Announces Fiscal 2012 Full Year and Fourth Quarter Results

Fiscal 2012 Performance:

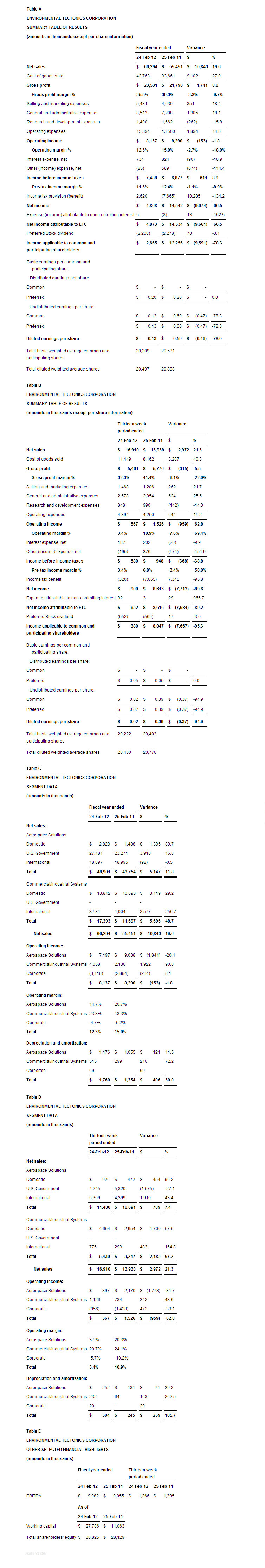

- Net sales increased 19.6% to record $66.3 million

- Income before income taxes increased 8.9% to record $7.5 million

- Diluted earnings per share of $0.13

- Backlog of $74.5 million at February 24, 2012

- Record EBITDA of $10.0 million

SOUTHAMPTON, PA, USA, August 2, 2012 – Environmental Tectonics Corporation (OTCQB: ETCC) (“ETC” or the “Company”) today reported net sales for fiscal 2012 of $66.3 million, an increase of $10.8 million, or 19.6% over net sales of $55.5 million in fiscal 2011. The increase reflects increased sales to Domestic customers, to the U.S. Government, and to International customers.

As a result of higher net sales, income before income taxes for fiscal 2012 increased to $7.5 million, an 8.9% increase over fiscal 2011. Net income attributable to ETC was affected by an income tax provision of $2.6 million for fiscal 2012, compared to an income tax benefit of $7.7 million in fiscal 2011, reflecting reductions in the Company’s deferred tax asset reserve related to the expected realization of federal net operating loss carryforwards. As a result, ETC had net income of $4.9 million, or $0.13 per diluted share for fiscal 2012 versus $14.5 million, or $0.59 per diluted share in fiscal 2011, a decrease in net income of $9.7 million, or 66.5%.

William F. Mitchell, ETC’s President and Chief Executive Officer, stated, “We are very pleased that for the fiscal year ended February 24, 2012, ETC had record net sales and income before income taxes. This is the fifth consecutive year of substantial growth in both net sales and income before income taxes.”

Fiscal 2012 Results of Operations:

Domestic sales for fiscal 2012 were $16.6 million, an increase of $4.5 million, or 36.6%, over fiscal 2011, and represented 25.1% of net sales in fiscal 2012 compared to 22.0% in fiscal 2011. The increase in Domestic sales is primarily a result of a $1.4 million, or 127.3%, increase in the sale of hyperbaric chambers, which reflects a rebound in capital spending, a $1.1 million, or 168.1%, increase in the sale of environmental products as global automobile manufacturing rebounds, and a $1.0 million, or 113.2%, increase in the sale of simulation products, as well as smaller increases in other categories.

U.S. Government sales for fiscal 2012 were $27.2 million, an increase of $3.9 million, or 16.8%, over fiscal 2011, which reflect sales related to a suite of altitude chambers. U.S. Government sales represented 41.0% of net sales in fiscal 2012 compared with 41.9% in fiscal 2011. Given the existing progress made on U.S. Government sales contracts in the Company’s backlog, the Company anticipates the concentration of sales with the U.S. Government will begin to lessen in fiscal 2013.

International sales for fiscal 2012, including sales by our 95%-owned subsidiary in Poland, ETC-PZL Aerospace Industries SP. Z 0.0 (“ETC-PZL”), were $22.5 million, an increase of $2.5 million, or 12.4%, over fiscal 2011, due primarily to a $1.9 million, or 244.3%, increase in the sale of hyperbaric equipment, and a $1.5 million increase in sales of ETC-PZL. Increases were also experienced in the international sale of environmental equipment and simulation systems, offset in part, by a reduction in sales of altitude chambers. In aggregate, International sales represented 33.9% of the Company’s net sales in fiscal 2012, down from 36.1% in fiscal 2011. International sales totaling at least $500,000 per country, listed in order of magnitude, were made to customers in South Korea, Saudi Arabia, Japan, Spain, Poland, Malaysia, Kazakhstan, and China.

Segment sales

For fiscal 2012, we have changed our reporting segments to Aerospace Solutions (“Aerospace”) and Commercial/Industrial Systems (“CIS”) from Training Services Group (“TSG”) and Control Systems Group (“CSG”). We believe that this change more closely describes our markets, and aligns our products with how ETC manages its business and approaches these markets. The most significant change is that our altitude chamber business has moved from CSG into Aerospace because these chambers are primarily used to provide hypoxia training and are marketed along with our other Aerospace products. What is left in the former CSG is marketed to commercial and industrial customers; thus, a name change for the segment to CIS. Fiscal 2011 segment financial information has been restated to reflect this change in segments.

Aerospace sales were $48.9 million for fiscal 2012, an increase of $5.1 million, or 11.8%, over sales of $43.8 million in fiscal 2011. Sales of these products accounted for 73.8% of our net sales for fiscal 2012 versus 78.9% in fiscal 2011. CIS sales increased $5.7 million, or 48.7%, and constituted 26.2% of our net sales for fiscal 2012 compared to 21.1% in fiscal 2011.

Gross profit

Gross profit for fiscal 2012 increased by $1.7 million, or 8.0%, over fiscal 2011. This improvement reflects the increase in sales and resulting gross profit. Gross profit margin as a percent of net sales dropped to 35.5% in fiscal 2012 from 39.3% in fiscal 2011 due primarily to costs related to a U.S. government contract and to product mix.

Operating expenses

Selling and marketing expenses for fiscal 2012 of $5.5 million increased by $0.9 million, or 18.4%, over fiscal 2011, due primarily to the employment of additional sales people and their related travel expenses. As a percentage of net sales, selling and marketing expenses were 8.3% in both fiscal 2012 and fiscal 2011.

General and administrative expenses for fiscal 2012 of $8.5 million increased by $1.3 million, or 18.1%, over fiscal 2011. The increase is primarily the result of an increase in salaries, European operations, consulting expenses, and expenses relating to the independent internal investigation by the Audit Committee of our Board of Directors. As a percentage of net sales, general and administrative expenses decreased to 12.8% in fiscal 2012 compared to 13.0% in fiscal 2011.

Research and development expenses include spending for potential new products and technologies, and internationally, work performed under government grant programs. This spending, net of grant payments from the Polish and Turkish governments, totaled $1.4 million for fiscal 2012 compared to $1.7 million in fiscal 2011, a decrease of $0.3 million, or 15.8%. The decrease was a result of more research and development employees being assigned to specific contracts; thus, expenses related to these employees were included in cost of sales in fiscal 2012. Most of the Company’s research efforts, which were and continue to be a significant cost of its business, are included in cost of sales for applied research for specific contracts, as well as research for feasibility and technology updates. As a percentage of net sales, research and development expenses were 2.1% in fiscal 2012 compared to 3.0% in fiscal 2011.

Operating income

Operating income decreased $0.2 million, or 1.8%, to $8.1 million for fiscal 2012 compared to $8.3 million in fiscal 2011. The higher level of gross profit from increased net sales was more than offset by an 18.4% increase in selling and marketing expenses and an 18.1% increase in general and administrative expenses.

On a segment basis, Aerospace had operating income of $7.2 million for fiscal 2012, a $1.8 million, or 20.4%, reduction from operating income of $9.0 million in fiscal 2011. CIS had operating income of $4.1 million for fiscal 2012, an increase of $1.9 million, or 90.0%, over fiscal 2011. These segment operating results were offset, in part, by unallocated corporate expenses.

Interest expense, other income and expense, and taxes

Interest expense, net for fiscal 2012 was $0.7 million compared to $0.8 million in fiscal 2011, a decrease of $0.1 million, or 10.9%. The decline primarily reflects lower borrowing at ETC-PZL, which was partially offset by increased interest on higher borrowing domestically.

Other income, net for fiscal 2012 was $0.1 million compared to other expense, net of $0.6 million in fiscal 2011, a decrease of $0.7 million. These expenses consist primarily of bank and letter of credit fees, as well as foreign currency exchange gains and losses.

As of February 24, 2012, the Company reviewed the components of its deferred tax assets and determined, based upon all available information, that its current and expected future operating income will more likely than not result in the realization of its deferred tax assets relating to its federal net operating loss carryforwards. The Company has a net deferred tax asset related primarily to its federal net operating loss carryforwards of $8.4 million. Income tax provisions of $2.6 million were recorded in fiscal 2012. This follows a $7.7 million benefit recorded in fiscal 2011, which significantly reduced the valuation allowance against the Company’s deferred tax asset. Due to the utilization of federal net operating loss carry forwards available, and valuation allowances on the deferred tax asset in the 2011 first three quarters, the Company did not record an income tax provision on income in the 2011 first three quarters.

As of February 24, 2012, the Company had approximately $23.2 million of federal net loss carry forwards available to offset future income tax liabilities, which begin to expire in 2025. In addition, the Company has the ability to offset deferred tax assets against deferred tax liabilities created for such items as depreciation and amortization.

Net income attributable to ETC

Net income attributable to ETC was affected by an income tax provision of $2.6 million for fiscal 2012, compared to an income tax benefit of $7.7 million in fiscal 2011, reflecting reductions in the Company’s deferred tax asset reserve related to the expected realization of federal net operating loss carryforwards. As a result, net income attributable to ETC was $4.9 million, or $0.13 per diluted share, for fiscal 2012 versus $14.5 million, or $0.59 per diluted share in fiscal 2011, a decrease in net income attributable to ETC of $9.7 million, or 66.5%.

Fiscal 2012 Fourth Quarter Results of Operations:

Net sales for the fiscal 2012 fourth quarter (“the 2012 quarter”) of $16.9 million, increased $3.0 million, or 21.3% over net sales of $13.9 million in the fiscal 2011 fourth quarter (‘the 2011 quarter”). The increase reflects increased sales to Domestic customers, to the U.S. Government, and to International customers.

As a result of higher net sales, which were more than offset by higher costs in the 2012 quarter related to a U.S. Government contract and lower gross margins at a foreign subsidiary, increased selling and marketing expenses, and increased general and administrative expenses, income before income taxes was $0.6 million, a $0.4 million decrease, or 38.8%, from the 2011 quarter. Net income attributable to ETC was affected by an income tax benefit of $0.3 million in the 2012 quarter compared to an income tax benefit of $7.7 million in the 2011 quarter, reflecting reductions in the Company’s deferred tax asset reserve related to the expected realization of its federal net operating loss carryforwards. As a result, net income attributable to ETC was $0.9 million in the 2012 quarter, or $0.02 per diluted share, versus $8.6 million, or $0.39 per diluted share, in the 2011 quarter.

Domestic sales for the 2012 quarter were $5.6 million, an increase of $2.2 million, or 62.9%, over the 2011 quarter, and represented 33.0% of net sales, compared to 24.6% in the 2011 quarter. The increase in Domestic sales is primarily a result of increased sales of hyperbaric, environmental, and sterilizer products.

U.S. Government sales for the 2012 quarter were $4.2 million, a decrease of $1.6 million, or 27.1%, from the 2011 quarter, which reflects the progress that has been made on a U.S. Navy project. U.S. Government sales represented 25.1% of net sales in the 2012 quarter compared with 41.8% in the 2011 quarter.

International sales for the 2012 quarter, including sales by ETC-PZL, were $7.1 million, an increase of $2.4 million, or 51.0%, over the 2011 quarter, due primarily to sales to Saudi Arabia and sales of ETC-PZL. International sales represented 41.9% of net sales in the 2012 quarter compared to 33.6% in the 2011 quarter.

Segment sales

For fiscal 2012, we have changed our reporting segments to Aerospace Solutions (“Aerospace”) and Commercial/Industrial Systems (“CIS”) from Training Services Group (“TSG”) and Control Systems Group (“CSG”). We believe that this change more closely describes our markets, and aligns our products with how ETC manages its business and approaches these markets. The most significant change is that our altitude chamber business has moved from CSG into Aerospace because these chambers are primarily used to provide hypoxia training and are marketed along with our other Aerospace products. What is left in the former CSG is marketed to commercial and industrial customers; thus, a name change for the segment to CIS. Fiscal 2011 segment financial information has been restated to reflect this change in segments.

Aerospace sales were $11.5 million for the 2012 quarter, an increase of $0.8 million, or 7.4%, over sales of $10.7 million in the 2011 quarter. Sales of these products accounted for 67.9% of our net sales in the 2012 quarter versus 76.7% in the 2011 quarter. CIS sales were $5.4 million for the 2012 quarter, an increase of $2.2 million, or 67.2%, over sales of $3.2 million in the 2011 quarter, and constituted 32.1% of our net sales in the 2012 quarter compared to 23.3% in the 2011 quarter.

Gross profit

Gross profit for the 2012 quarter was $5.5 million compared to $5.8 million for the 2011 quarter, a decrease of $0.3 million, or 5.5%. The reduction in the gross profit reflects lower gross margins resulting primarily from costs related to a U.S. Government contract and lower gross margins at ETC-PZL.

Operating expenses

Selling and marketing expenses in the 2012 quarter of $1.5 million, increased $0.3 million, or 21.7%, over the 2011 quarter, due primarily to the employment of additional sales people and their related travel expenses and commissions. As a percentage of net sales, selling and marketing expenses were 8.7% in both the 2012 quarter and the 2011 quarter.

General and administrative expenses in the 2012 quarter of $2.6 million increased $0.5 million, or 25.5%, over the 2011 quarter. The increase is primarily the result of an increase in salaries, European operations, consulting expenses, and expenses relating to the independent internal investigation by the Audit Committee of our Board of Directors. As a percentage of net sales, general and administrative expenses increased to 15.2% in the 2012 quarter compared to 14.7% in the 2011 quarter.

Research and development expenses include spending for potential new products and technologies, and internationally, work performed under government grant programs. This spending, net of grant payments from the Polish and Turkish governments, totaled $0.8 million for the 2012 quarter compared to $1.0 million in the 2011 quarter, a decrease of $0.1 million, or 14.3%. The decrease was a result of more research and development employees being assigned to specific contracts; thus, expenses related to these employees were included in cost of sales in the 2012 quarter. Most of the Company’s research efforts, which were and continue to be a significant cost of its business, are included in cost of sales for applied research for specific contracts, as well as research for feasibility and technology updates. As a percentage of net sales, research and development expenses decreased to 5.0% in the 2012 quarter compared to 7.1% in the 2011 quarter.

Operating income

Operating income decreased to $0.6 million for the 2012 quarter from $1.5 million in the 2011 quarter. This reduction in operating income reflects the effect of higher sales, which were more than offset by lower gross margins on those sales, as well as increased operating expenses, though lower as a percentage of net sales.

On a segment basis, Aerospace had operating income of $0.4 million for the 2012 quarter, a $1.8 million reduction from operating income of $2.2 million in the 2011 quarter. This reduction is primarily due to costs related to a U.S. Government contract and lower gross margins at ETC-PZL. CIS had operating income of $1.1 million for the 2012 quarter, an increase of $0.3 million over the 2011 quarter. These segment operating results were offset, in part, by unallocated corporate expenses.

Interest expense, other income and expense, and taxes

Interest expense, net for both the 2012 quarter and the 2011 quarter was $0.2 million.

Other income, net for the 2012 quarter was $0.2 million compared to other expense, net of $0.4 million in the 2011 quarter, a decrease of $0.6 million. This income or expense consists primarily of bank and letter of credit fees, as well as foreign currency exchange gains and losses.

As of February 24, 2012, the Company reviewed the components of its deferred tax assets and determined, based upon all available information, that its current and expected future operating income will more likely than not result in the realization of its deferred tax assets relating to its federal net operating loss carryforwards. The Company has a net deferred tax asset related primarily to its federal net operating loss carryforwards of $8.4 million.

As of February 24, 2012, the Company had approximately $23.2 million of federal net loss carry forwards available to offset future income tax liabilities, which begin to expire in 2025. In addition, the Company has the ability to offset deferred tax assets against deferred tax liabilities created for such items as depreciation and amortization.

Net income attributable to ETC

Net income attributable to ETC was $0.9 million, or $0.02 per diluted share, for the 2012 quarter versus $8.6 million, or $0.39 per diluted share, in the 2011 quarter; a decrease in net income attributable to ETC of $7.7 million. In addition to the changes that affected operating income, net income attributable to ETC was affected by an income tax benefit of $0.3 million in the 2012 quarter compared to an income tax benefit of $7.7 million in the 2011 quarter, reflecting reductions in the Company’s deferred tax asset reserve related to the expected realization of its federal net operating loss carryforwards.

Liquidity and capital resources

As a result of an elevated level of production to satisfy the requirements of long-term contracts in the Company’s backlog of $110.6 million entering fiscal 2012, the Company borrowed under its line of credit to fund operating activities during fiscal 2012. As of February 24, 2012, the Company’s availability under the PNC Credit Agreement was $2.5 million. This reflected cash borrowing under the PNC Credit Agreement of $16.7 million and outstanding letters of credit of approximately $0.8 million. The Company expects the availability to begin increasing as several of our long-term contracts with back loaded cash receipts begin to wind down. Working capital, or current assets less current liabilities, was $27.8 million and $11.1 million at February 24, 2012 and February 25, 2011, respectively. The increase in working capital was primarily the result of the Company borrowing against its long-term line of credit to finance increasing costs in excess of billings on uncompleted long-term contracts, which will reduce upon the achievement of certain milestones. The Company’s current ratio, current assets divided by current liabilities, improved to 2.4:1 at February 24, 2012 from 1.6:1 at February 25, 2011.

Financial Tables Follow

Forward-looking Statements

This news release contains forward-looking statements, which are based on management's expectations and are subject to uncertainties and changes in circumstances. Words and expressions reflecting something other than historical fact are intended to identify forward-looking statements, and these statements may include terminology such as "may", "will", "should", "expect", "plan", "anticipate", "believe", "estimate", "future", "predict", "potential", "intend", or "continue", and similar expressions. We base our forward-looking statements on our current expectations and projections about future events or future financial performance. Our forward-looking statements are subject to known and unknown risks, uncertainties and assumptions about ETC and its subsidiaries that may cause actual results to be materially different from any future results implied by these forward-looking statements. We caution you not to place undue reliance on these forward-looking statements.