Environmental Tectonics Corporation Announces Fiscal 2010 Results

Southampton, PA, May 27, 2010 — Environmental Tectonics Corporation (OTC Bulletin Board: ETCC) (“ETC” or the “Company”) today announced financial results for fiscal 2010 which ended on February 26, 2010.

The reader is referred to the Company’s Annual Report on Form 10-K for the period ended February 26, 2010 for additional information on the Company’s financial results.

Overview

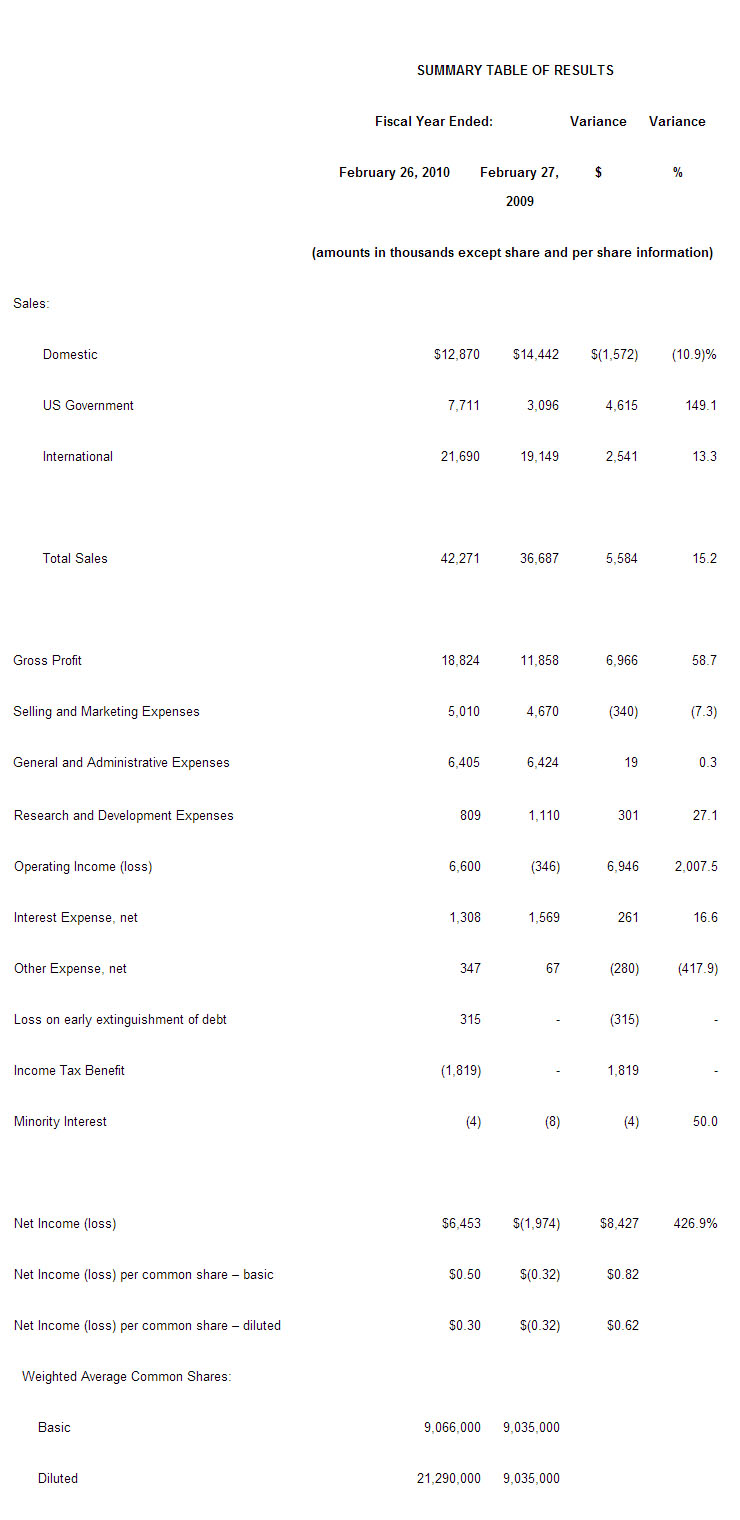

Total sales for fiscal 2010 were $42,271,000 versus $36,687,000 for fiscal 2009, an increase of $5,584,000 or 15.2%. Net income was $6,453,000 or $0.30 per share (diluted), in fiscal 2010 versus a net loss of $1,974,000, or $(0.32) per share (diluted), in fiscal 2009, an increase in net income of $8,427,000 or 426.9%. Operating profit in fiscal 2010 was $6,600,000 versus an operating loss of $346,000 in fiscal 2009, an increase in operating profit of $6,946,000. The major factor contributing to the favorable performance in both operating and net income was an increase in sales and corresponding gross profit. Increased gross profit reflected the sales increase and a 12.2 percentage point increase in the gross margin rate. Net income also benefited by an income tax benefit of $1,819,000 resulting from a reduction in the Company’s deferred tax asset reserve related to the expected realization of net operating loss carry forwards.

Sales

For the fiscal year ended February 26, 2010, total sales were $42,271,000, an increase of $5,584,000 or 15.2% from fiscal 2009. The increase reflected favorable performance in the U.S. Government and international geographic areas and in the pilot training, simulation and sterilizer product lines.

Geographically, domestic sales were $12,870,000, down $1,572,000, or 10.9%, from fiscal 2009, and represented 30.4% of total sales, down from 39.4% in fiscal 2009. The current period reflected reductions in Environmental (down $2,861,000, 74.5%) and Hyperbaric (down $1,143,000, 26.8%) partially offset by increased Sterilizer sales (up $2,156,000, 58.5%). Environmental sales in the prior period benefited from significant work on a large domestic automotive contract basically completed by the prior fiscal year end. Reduced Hyperbaric sales reflected domestic economic disruptions and resulting reduced capital spending. Conversely, Sterilizer sales benefited from production on two significant orders. U.S. Government sales increased $4,615,000 or 149.1% from the prior fiscal year. Significant increases were evidenced in Aircrew Training Systems sales reflecting three contracts with three different U.S. defense agencies. U.S. Government sales represented 18.3% of total sales, up from 8.4% in fiscal 2009. International sales, including those in the Company’s foreign subsidiaries, were $21,690,000, up $2,541,000 or 13.3%, from the prior fiscal period, primarily due to increased simulation and environmental sales, and represented 51.3% of total sales, down slightly from 52.2% in fiscal 2009.

Segment Sales

Sales of our Training Services Group (TSG) products were $26,035,000 in fiscal 2010, an increase of $5,427,000, or 26.3% from fiscal 2009. Sales of these products accounted for 61.6% of our sales versus 56.2% in fiscal 2009. Sales in our other segment, the Control Systems Group (CSG), increased $157,000 or 1.0%, and constituted 38.4% of our total sales compared to 43.8% in fiscal 2009.

Gross Profit

Gross profit for fiscal 2010 increased by $6,966,000 or 58.7%, from fiscal 2009. This reflected the increase in sales and resulting gross profit (approximately $1.9 million). Improvement in gross margin as a percent of sales was due to higher sales in the TSG segment, which included high gross profit projects. Gross profit rate as a percent of sales improved to 44.5% for fiscal 2010 versus 32.3% for fiscal 2009. Significantly favorable margin rates were realized internationally in simulation and aircrew training systems and domestically in sterilizers.

Selling and Marketing Expenses

Selling and Marketing Expenses increased $340,000, or 7.3%, from fiscal 2009. This increase primarily reflected increased marketing expenses (commissions and bid and proposal costs). As a percentage of sales, selling and marketing expenses were 11.9% in fiscal 2010 compared to 12.7% in fiscal 2009.

General and Administrative Expenses

General and Administrative Expenses decreased by $19,000 or 0.3%. As a percentage of sales, general and administrative expenses were 15.2% compared to 17.5% in fiscal 2009.

Research and Development Expenses

Research and Development Expenses include spending for potential new products and technologies and work performed under government grant programs, both in the United States and internationally. This spending, net of grant payments from the U.S., Polish and Turkish Governments, totaled $809,000 in fiscal 2010 as compared to $1,110,000 for fiscal 2009, a decrease of $301,000 or 27.1%. Gross spending for the periods was $2,846,000 and $1,195,000, which amounts were partially offset by funds under government grants in ETC Southampton, ETC-PZL, and our Turkish operation.

Operating Income

Operating Income was $6,600,000 in fiscal 2010 compared to an operating loss of $346,000 in fiscal 2009, an increase in income of $6,946,000. This improvement in operating results represented a combination of higher sales volume and gross profit coupled with reduced research and development expenses. On a segment basis, the TSG had an operating income of $6,128,000, a $3,697,000 improvement over the segment operating income of $2,431,000 in fiscal 2009. The CSG had an operating income of $1,727,000 in fiscal 2010, an increase in operating income of $3,224,000 from fiscal 2009. These segment operating results were offset, in part, by unallocated corporate expenses of $1,255,000 which were down $25,000 from fiscal 2009.

Interest Expense

Interest Expense for fiscal 2010 was $1,308,000 as compared to $1,569,000 for fiscal 2009, a decrease of $261,000 or 16.6%. The current period expense reflected a $702,000 decrease in bank borrowings and reduced interest expense on the Company’s subordinated debt. This debt was exchanged for preferred stock pursuant to a transaction approved by the Company’s shareholders on July 2, 2009.

Other Income/Expense, Net

Other Income/Expense, Net, was a net expense of $347,000 for fiscal 2010 versus a net expense of $67,000 for fiscal 2009. The current period consisted primarily of foreign currency exchange losses whereas the prior period included proceeds from a property damage claim and a litigation settlement.

Loss on Extinguishment of Debt

During fiscal 2010, the Company recorded a loss on extinguishment of debt representing two transactions. In the transaction approved by the shareholders on July 2009, the Company’s Subordinated Note was exchanged for preferred stock, resulting in a charge of $224,000, which represented the unamortized portion of the debt discount that was recorded at the issuance of this instrument. Additionally, a charge of $91,000 resulted from the unamortized portion of the debt discount on a $2 million note, which was repaid on September 1, 2009.

Income Taxes

As a result of the Company’s analysis during fiscal 2010 of the various components and realizability of the Company’s net loss carry forwards, an income tax benefit of $1,819,000 was recorded in fiscal 2010. No income tax expense or benefit was recorded in fiscal 2009.

Liquidity and Capital Resources

The Company’s liquidity position and borrowing availability improved significantly during fiscal 2010. Cash flow from operations was a positive $5,272,000 and net cash increased by $1,888,000. Working Capital was $15,326,000 and $4,684,000 as of February 26, 2010 and February 27, 2009, respectively. This positive performance primarily reflected the net income in the period and milestone payment collections under long term contracts. During fiscal 2010, availability under our existing bank line increased by $5,000,000 and we also established a $7,500,000 operating line with H. F. Lenfest to fund certain U.S. Government contracts.

William F. Mitchell, ETC’s President and Chairman, stated, “Our financial results for fiscal 2010 represent an extremely satisfying payback on our multi-year investment in Tactical Flight Simulation. While the road has been rough, and at times almost impassable, we have never lost our focus on advancing sophisticated pilot training. ETC is a technology based company; our belief is that “good” technology will “find a way” and ultimately pay for itself in many ways. That we have succeeded while many companies around us have struggled is, in my opinion, the proof of this tenet.

Special thanks go out to Gerry Lenfest for his continuing and significant support. He was one of the first to recognize the importance of our Fighter Technology; and it was through his financial support over the last several years that that our first true tactical system was built.

Forward-looking Statements

This news release contains forward-looking statements, which are based on management's expectations and are subject to uncertainties and changes in circumstances. Words and expressions reflecting something other than historical fact are intended to identify forward-looking statements, and these statements may include terminology such as "may", "will", "should", "expect", "plan", "anticipate", "believe", "estimate", "future", "predict", "potential", "intend", or "continue", and similar expressions. We base our forward-looking statements on our current expectations and projections about future events or future financial performance. Our forward-looking statements are subject to known and unknown risks, uncertainties and assumptions about ETC and its subsidiaries that may cause actual results to be materially different from any future results implied by these forward-looking statements. We caution you not to place undue reliance on these forward-looking statements.